Welcome to the life journey of Mr P.R. Sundar with Finosauras. Have you ever heard of a guy who bought his first pair of slippers at 16 and now parks his Jaguar in a ₹30 crore penthouse? Meet P.R. Sundar - math teacher turned money maestro. His story ain’t your typical "get-rich-quick" tale. It’s messier, louder, and way more fascinating.

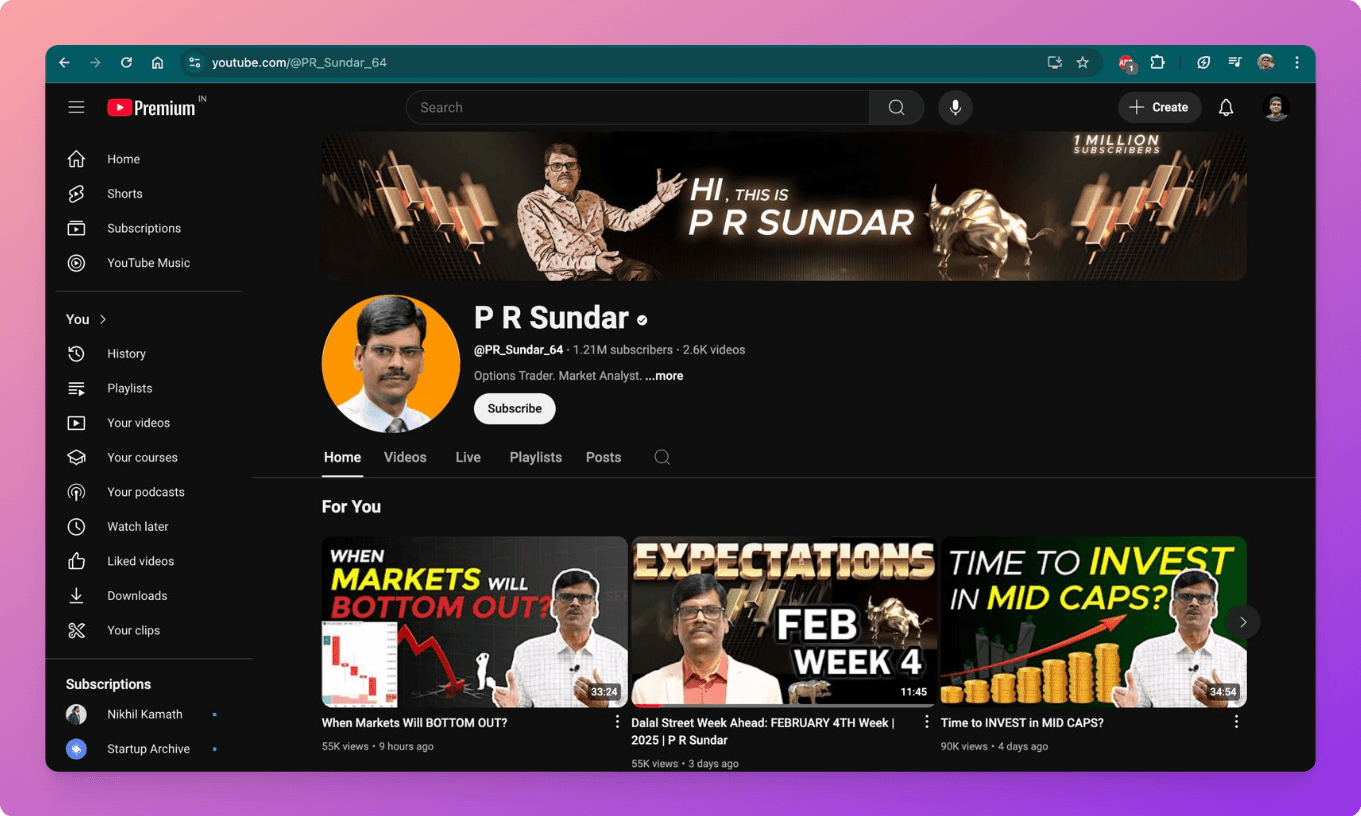

With over 1 million YouTube subscribers, Sundar’s the guy you watch when you want to decode stock markets but end up staring at his Dubai apartment views. But here’s the twist: while some call him the "Wizard of Dalal Street," others slam his Rs 59K workshops, which required ₹20 lakh trading capital, as overhyped. Love him or side-eye him, you can’t ignore him.

And just like 1000+ traders, you can get access of P.R. Sundar & other 50+ SEBI RAs recommendations here.

Stick around. We’re diving into how a middle-class kid from Tamil Nadu cracked the code to luxury cars, SEBI scandals, and turning options trading into a viral sensation.

Table of Content

- Early Life & Education

- Career: From Teacher to Trading Tycoon

- PR Sundar's Real Story on His Investment Journey

- PR Sundar Controversies & Scandals

- PR Sundar’s Personal Life & Assets

- What Does PR Sundar’s Journey Teach Us?

Early Life & Education

Purisai, a sleepy village in Tamil Nadu, 1964. A young Sundar grows up in a family where money’s tighter than a locked safe.

Seven siblings, a father breaking his back in Gulf construction sites, and a childhood where owning slippers was a milestone celebrated at 16. Yet, here’s the thing—this kid wasn’t just surviving. He was crunching numbers like they owed him money.

After nailing a postgraduate degree in math from Chennai, jobs in the South were scarce. So Sundar did what any hustler would: packed his bags for Gujarat.

For a Tamil-medium student, teaching math in a Gujarati school wasn’t just a job—it was a crash course in adaptability. But little did he know, Gujarat had a surprise waiting. The state’s buzzing stock market culture caught his eye. “Markets are all about numbers,” he’d say later. “It felt like fate.”

Then came the plot twist.

In 1993, Singapore came knocking with a teaching offer. For 12 years, he chalked equations abroad, squirreling away savings.

By 2005, he’d saved enough to ask: What’s next? Teaching paid the bills, but his heart? He was already trading futures in his head.

So he returned to India, cash in hand, ready to bet on himself. The classroom had taught him discipline. Now, the markets would teach him audacity. And boy, did he listen.

Read Next -> Net worth of Raamdeo Agrawal

Career: From Teacher to Trading Tycoon

In 2005 while most of us were still figuring out Facebook, he quietly started trading. His first bets? Companies like Aban Offshore (oil rigs), Camlin Ltd (stationery!), and L&T (construction giants).

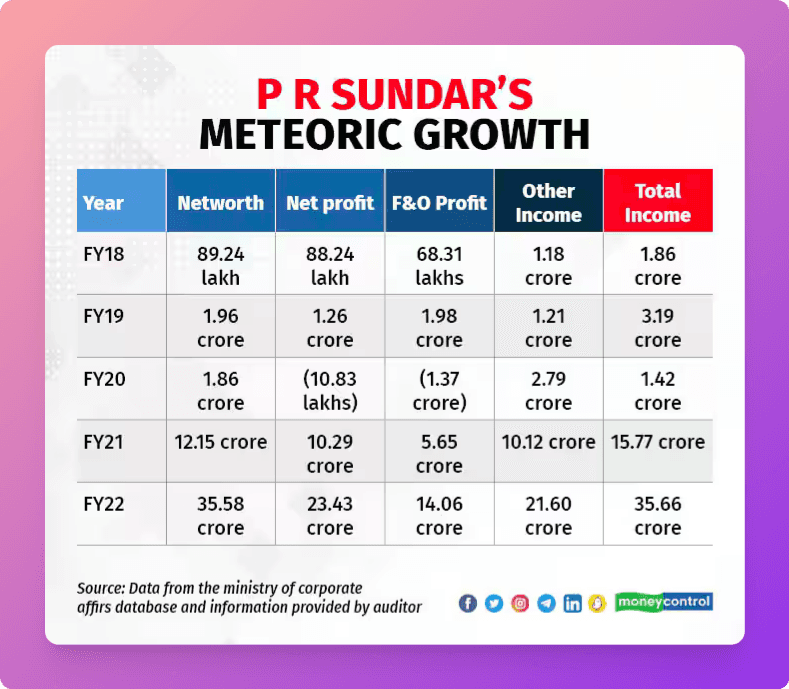

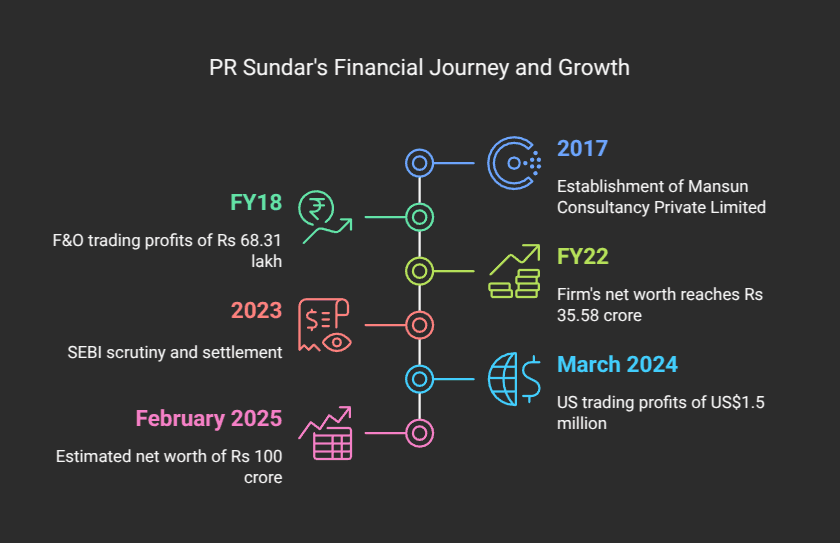

By 2017, he launched Mansun Consultancy - a fancy name for what’s basically his trading brainchild. Started small (₹88.24L net profit in FY18), but by 2022? Boom. ₹23.43 crore. This also included his personal Future and Options transaction worth ₹14.06 crore.

Social Media Rise: The Finfluencer and Trading Genius

Sundar's story isn’t just about numbers and trades; it’s also about building trust and making a mark in the digital world.

In one of his popular YouTube videos, he opens up about his 15-year journey in the stock market, sharing his ups and downs in a refreshingly candid manner.

He talks about how, even back when he was just a teacher, he knew that real success comes with patience and persistence. From holding free workshops that barely attracted a crowd to gradually increasing his fees from a modest 3,000 rupees to 60,000 rupees.

His practical, no-nonsense approach—advising small investors not to get lured by big, flashy profit screenshots—resonated with many.

Sundar explains that consistent returns of 20-30% are far more sustainable than wild, risky bets that might yield huge gains in a minute but could wipe out your capital in the long run.

It wasn’t long before his clarity and honesty caught the media’s attention. In 2018, he was invited as a speaker at the Traders Carnival in Mumbai, made appearances on CNBC, and even featured in an article on Money Control.

Today, his YouTube channel (over 1 million subscribers), X (600K+ followers), Telegram (68K+ Members) and Instagram (100K+ followers) are filled with practical tips and insights. He is mostly active on YouTube, sharing daily market insights. Check out his latest video:

PR Sundar's Real Story on His Investment Journey

P.R. Sundar isn’t your typical “buy low, sell high” guru. His real superpower? Turning boring dividends into crazy returns.

The High Dividend Yield: “Safe Stocks” That Made 300% Returns

Back in 2014, Sundar was a nervous “expert” on Sun TV’s Vagam show. People kept asking, “What stock should I buy?” Problem? He was a trader, not a fundamental analyst. So he played it safe:

His Picks (That Went Ballistic):

- Tata Investment Corp: Recommended at ₹400-450. Shot up to ₹1,500.

- R Group Stocks (Chennai-based): 300-500% returns.

- REC & PFC: Recommended at ₹900 (PFC) and ₹120 (REC). Now? ₹270-280 (PFC) and ₹220 post-bonus (REC).

Wait, how?

Sundar’s logic:

- Dividend Safety Net: Stocks like Coal India dropped 40% but still paid 10%+ dividends. “Hold, don’t sell. Let time fix the price.”

- Power Sector Revival: REC/PFC rode India’s power reforms (discom debt schemes, infrastructure lending).

- Bonus Bets: REC gave a 1:3 bonus share; PFC plans 1:1.

When “safe stocks” backfire

Sundar doesn’t sugarcoat. Two epic fails:

- The ITC situation: He recommended ITC for its dividends. Then, India axed dividend tax benefits for investors. Sundar panicked:“I thought ultra-rich investors would dump it. I declared ‘ITC is doomed!’”Reality: ITC surged 250%. Oops.

- The Crude Oil Misread: In 2014, he predicted crashing crude prices. Smart, right? He bought oil marketing stocks (IOC, HPCL). But…- Government Intervened: Raised taxes, blocked price cuts. - Stocks Crashed 10% overnight. - Meanwhile: Asian Paints (using cheap crude byproducts) doubled.

Sundar’s Lesson:

“News doesn’t matter. Your interpretation does. I missed the paint angle. My fault.”

Why Middle-Class India Loves Him (Despite the Flaws)

Sundar’s genius isn’t perfection - it’s relatability. He’s the guy who:

- Calls out his own blunders (“I’m no Warren Buffett!”).

- Preaches patience over FOMO (“Hold dividend stocks like an old uncle!”).

- Turns complex strategies into Tamil kitchen analogies (“Theta decay is like rasam evaporating!”).

This was all about how PR Sundar grew on social media and about his investment philosophy. Looks all good, right? Every coin has two sides.

PR Sundar Controversies & Scandals

PR Sundar’s journey in the world of finance isn’t without its bumps along the road. Despite his impressive rise from humble beginnings to becoming a popular trading influencer, he has faced serious challenges and criticisms that continue to stir up debate.

Regulatory Issues and SEBI’s Probe

One major controversy involves allegations that Sundar, through his firm Mansun Consultancy, was offering investment advice without the proper registration from SEBI. It was found that his blog was used to promote various advisory packages, with fees collected through a linked payment gateway.

In May 2023, SEBI settled the case by imposing penalties on Sundar, his co-promoter Mangayarkarasi Sundar, and Mansun Consultancy.

Each was fined ₹15.60 lakh, and they were collectively required to return over ₹6 crore (including interest), along with a one-year ban from dealing in securities.

Trading Practices and Misleading Claims

Beyond the regulatory issues, Sundar has also been criticized for the way he presents his trading success.

Many say that he only shows the winning trades and hides the losses, which can give a misleading picture of his actual performance. His bold promises—like claiming that making 100 crore is “not at all difficult”—have raised concerns among industry experts, who worry that such claims might lure inexperienced traders into taking high risks.

This, combined with his expensive masterclasses, has fueled debates about transparency and ethics in financial advice.

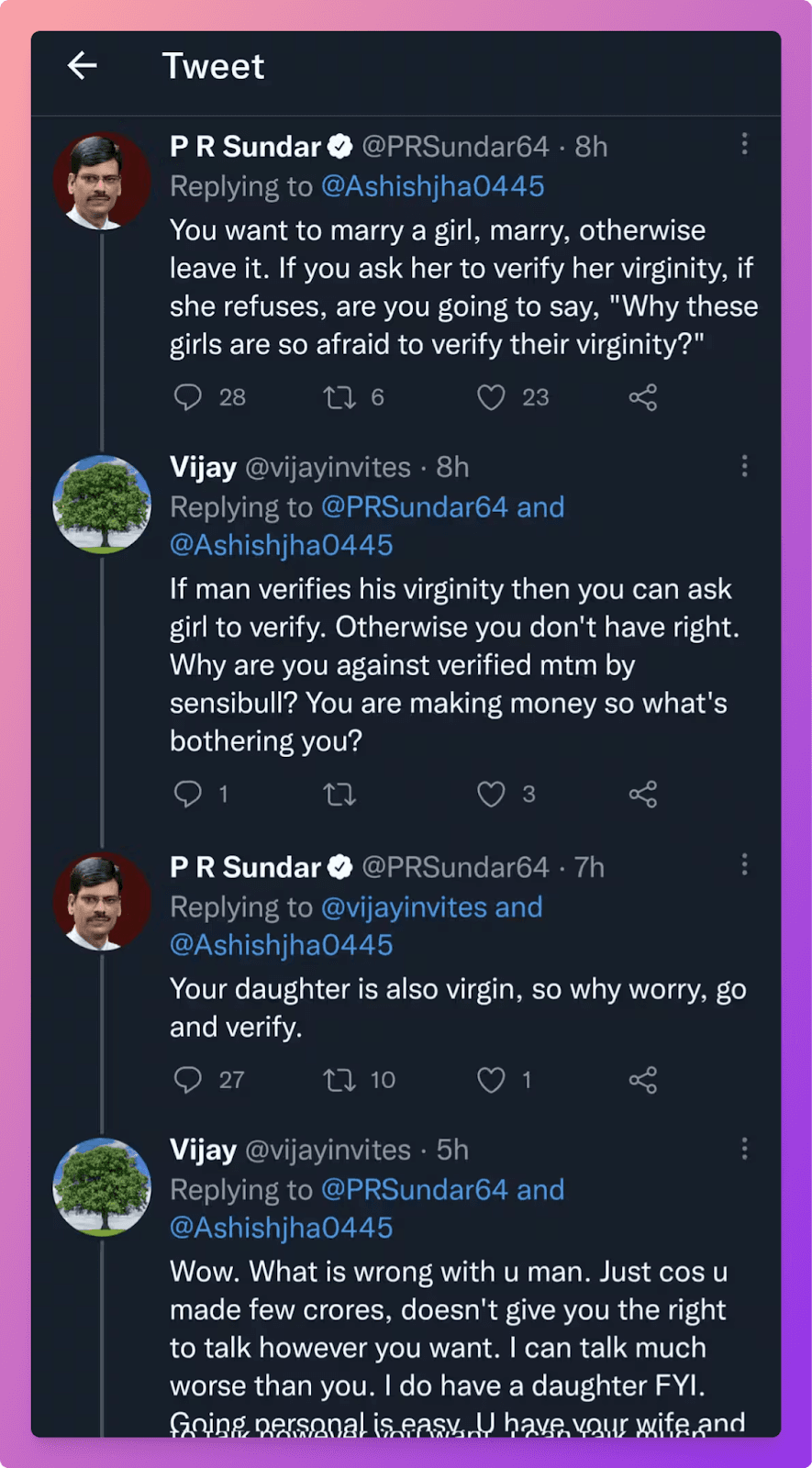

Twitter Feud over Mark to Market

In 2022, after replying about M2M gains, PR Sundar faces backlash on Twitter for being vulgar.

Later he apologized.

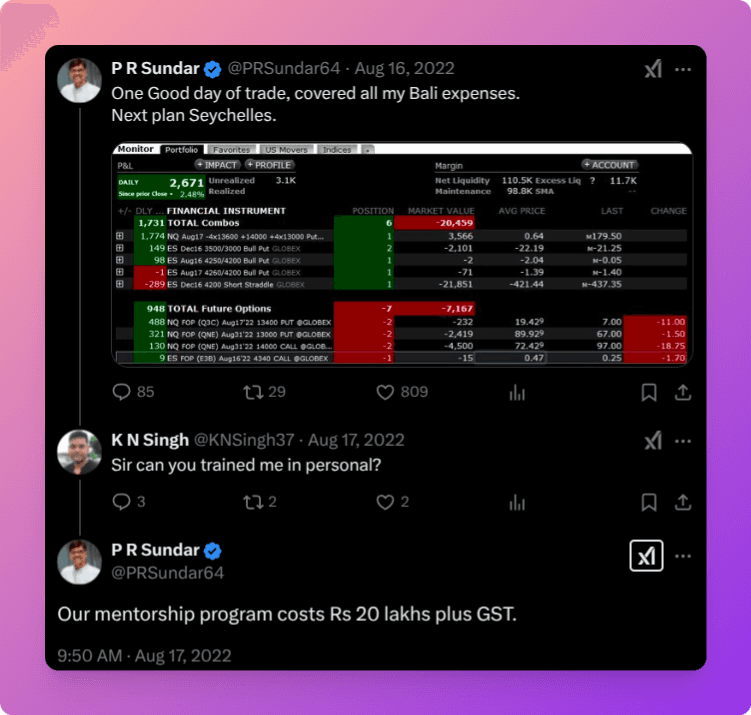

The 20L Mentorship Fee

In 2022, it was seen that he was charging a 20L mentorship fee. For this he justified by saying that his training isn’t for everyone—it's designed for traders who have significant capital (at least 25 lakh rupees) because trading futures and options, especially option selling, requires a robust financial base.

His offline workshop fee is about 70,000 rupees, which he points out is less than 3% of the capital a trader would typically use.

Sundar emphasizes that his workshop covers three key areas: simple yet effective trading strategies (with a few unique twists), methods for adjusting or “firefighting” when trades go wrong, and essential margin management techniques.

He also highlights that the higher cost of the offline workshop reflects additional expenses like travel and accommodation, plus it includes 2 to 3 months of hands-on support.

These were some controversies PR Sundar was stuck in from 2020-2023.

Reality of PR Sundar’s Workshops

Meet the guy from Fun Finance – he dropped ₹45,000 on PR Sundar’s 2-day trading workshop. Was it worth it? Here’s the unfiltered scoop, straight from his YouTube review:

“Don’t Come Broke”

Sundar’s team doesn’t sugarcoat it: You need ₹10L+ capital. Why? His “firefighting” strategies (saving losing trades) demand spare cash. The YouTuber says: “If you’re trading with ₹2-3L, you’ll drown adjusting positions.”

Workshop Blueprint

- Format: 2 days (9 AM–6:30 PM) on Zoom with 50+ attendees.

- Pre-Work: Watch strategy videos beforehand.

- Live Q&A: Ask Sundar anything – from “How to time markets?” to “Why did my trade blow up?”

What’s Actually Taught?

- 12-16 Adjustment Hacks: Rolling options, hedging, cutting losses. Nothing “secret” – but how to execute under panic.

- Mindset Fixes: “Stop praying for trades to recover. Exit like a pro,” says the reviewer.

- Risk Rules: Never risk more than 2% per trade. Margin hacks to free up capital.

The Harsh Truths

- ROI Reality: Expect 3-4% monthly returns. For ₹10L, that’s ₹30k – steady but not Lambo money.

- No “Underground” Tricks: Most strategies exist on Google. You’re paying for Sundar’s execution playbook.

What People think about PR Sundar?

We dove into Reddit and Quora to look at real chatter around PR Sundar. Here’s what the streets are saying:

1. The SEBI Saga: Trust vs. Controversy

In 2022, SEBI barred Sundar for a year(as we saw this above), accusing him of offering unregistered investment advice. The internet hasn’t forgotten:

- Critics Roar: “SEBI slaps a ban, but Moneycontrol still crowns him a ‘trading guru’? ” (176 upvotes).

- Supporters Push Back: “The ban’s over. Say what you want, his adjustment strategies work.”

2. Henlo, This Is PR Sundar” – Memes

His quirks live rent-free in traders’ minds:

- The Viral Greeting: “That ‘Henlo’ intro? I hear it in my sleep!” (10 upvotes).

- Budget Day Debacle: Users allege he once cut a live stream mid-loss, later claiming a “power cut” while posting profits.

Not only this, the million-dollar question is, he is a trader or influencer?

- Cynics: “Real sharks trade silently. Showmen sell courses.” (3 upvotes).

- Realists: “His P&L is public. Hate the hype".

PR Sundar’s Personal Life & Assets

Let’s break it down – Sundar’s life isn’t just charts and profits. Behind the Lamborghini-level glamour is a family man. Married to Mangaiyarkarasi, his college sweetheart, the couple’s son Ashwin runs a YouTube channel called Technology Jock (think gadgets, coding, and Gen-Z tech hype). While Ashwin isn’t a trader like his dad, he’s carved his own niche with 300K+ subscribers.

Now, the flex: Sundar’s Tamil Nadu penthouse isn’t just a home – it’s a ₹30 crore flex. He even gave fans a peek in a YouTube house tour, flaunting marble floors, panoramic city views, and what looks like a trading desk fancier than most office setups.

But the real drama? His garage.

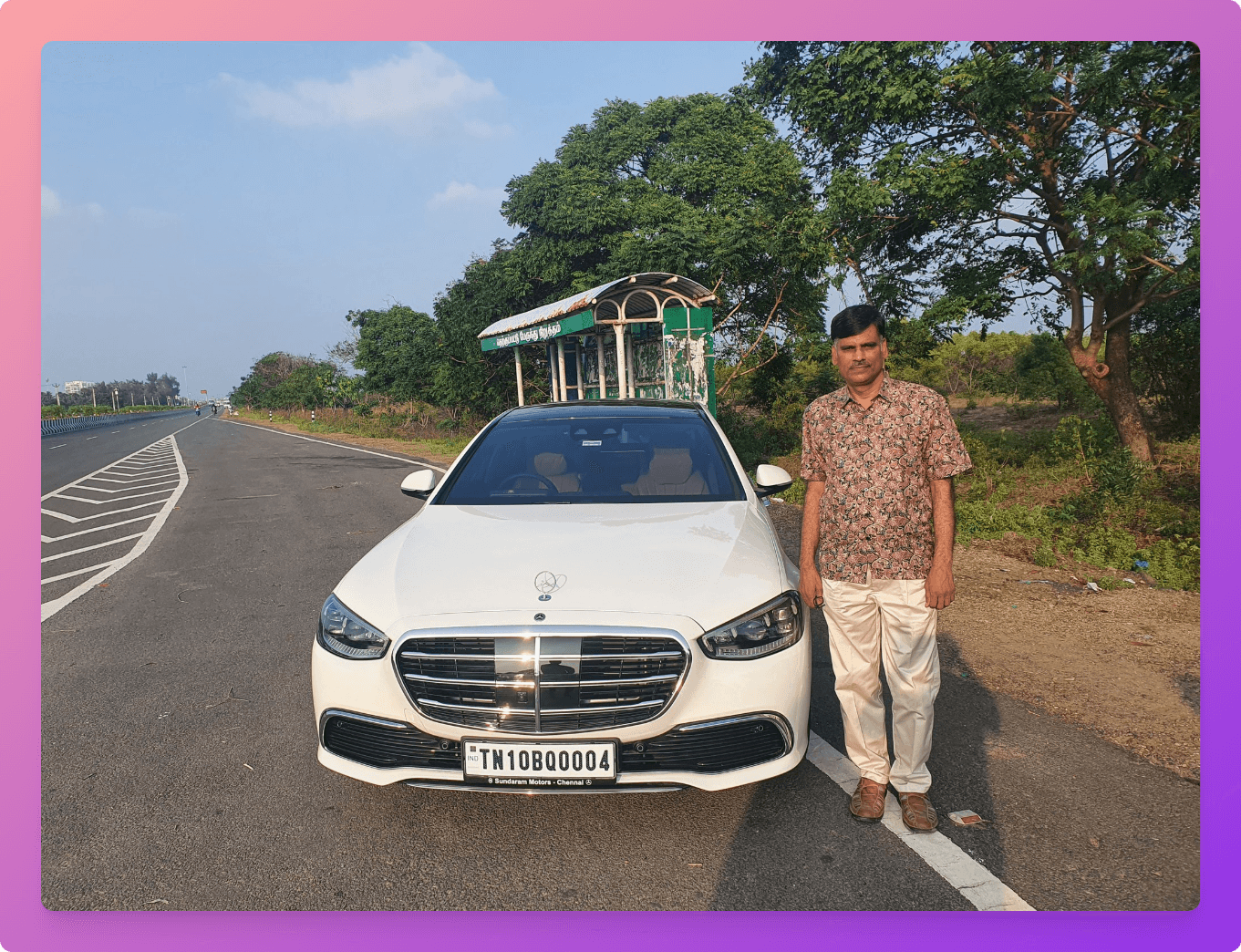

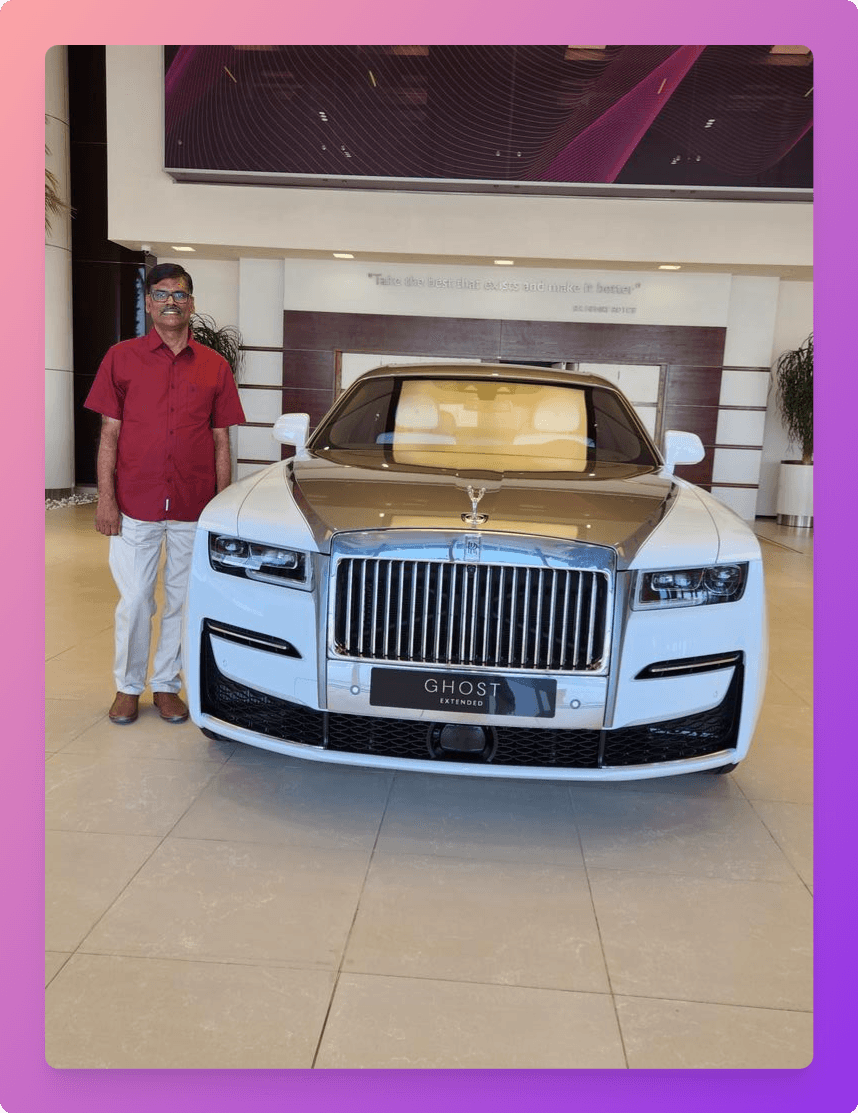

We’re talking Mercedes S-Class, XUV500, a Jaguar XF, and a Rolls-Royce Phantom with a Dubai license plate.

PR Sundar shopping for Rolls Royce in 2022, in the below image, we can see it’s a Ghost but later we found him with a Phantom with a Dubai number plate, as mentioned above.

Here’s the twist: that Rolls-Royce isn’t just for Dubai roads. In 2024, Indian car-spotting pages like @_mightyrides caught the Phantom zipping through Tamil Nadu with its UAE plates.

How? Likely via the carnet system—a temporary import permit for luxury cars. But why go through the hassle? Rumors swirl that Sundar owns a Dubai pad near the Burj Khalifa (because why not?), and shuttles the car between homes.

The man’s not just trading options; he’s optioning lifestyles💀.

PR Sundar’s Net Worth

Research suggests PR Sundar's net worth is around Rs 100-120+ crore, based on his company's financials and personal assets, though exact figures are not publicly disclosed.

- It seems likely that his wealth includes his share in Mansun Consultancy Private Limited, personal assets like a Rs 30 crore penthouse, and US trading profits.

- The evidence leans toward his net worth growing significantly, with his firm's net worth increasing 40-fold in five years to Rs 35.58 crore by 2022, and potentially higher now.

US Trading Profits

An unexpected detail is PR Sundar's involvement in US trading, disclosed through an X post from March 2024, where he stated achieving a target of US$1.5 million, up from US$1 million in November 2023 as per another X post.

Converting US$1.5 million at an exchange rate of approximately 83 INR per USD, this amounts to Rs 12.45 crore. By February 2025, assuming a 20% annual growth, this could reach around Rs 14.94 crore and more.

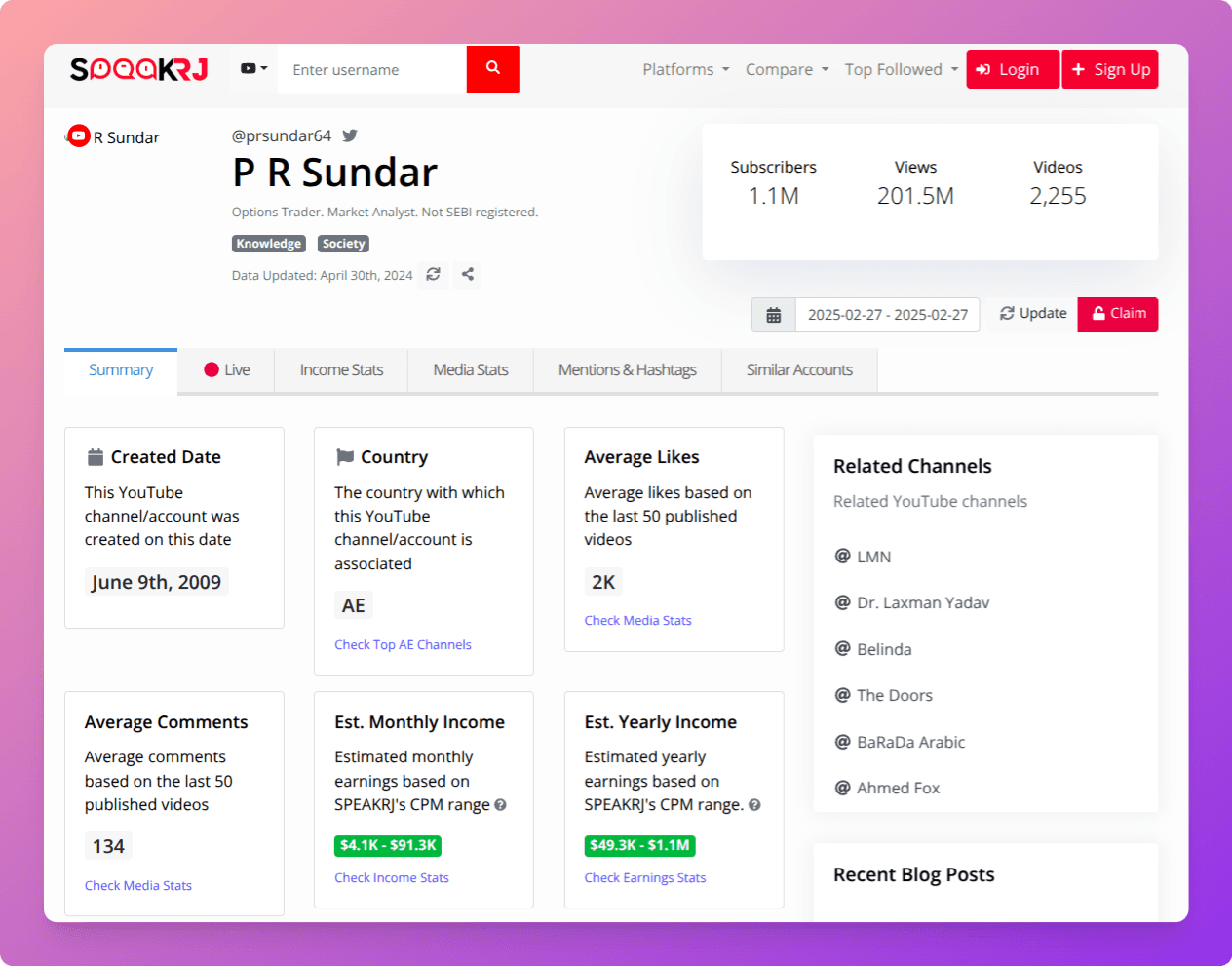

His YouTube channel with over 1 million subscribers and 200 million views (as per SPEAKRJ Stats), seminars, workshops, mentorship programs, and affiliate marketing. Estimating YouTube earnings at $2 per 1000 views, his channel could generate more than $300K+ annually (approximately Rs 3 crore), though this is likely a minor component compared to trading profits.

What Does PR Sundar’s Journey Teach Us?

Let’s cut through the noise. Sundar’s story isn’t just about Rolls and penthouses. It’s a masterclass in reinvention.

A math teacher who cracked the code to trading? That’s pure hustle meets curiosity. But here’s the thing: his rise also exposes the ugly side of the finfluencer world—SEBI probes, sky-high course fees, and debates about whether he earns more from mentoring than trading.

So, what’s the takeaway?

- Knowledge: Sundar didn’t wing it. His math background gave him an edge in decoding markets. Today, traders drowning in Instagram-style “get rich quick” reels need data-backed insights, not viral gimmicks.

- Transparency Matters: The SEBI saga reminds us: in finance, trust is currency. Follow mentors who show their trades, not just their cars.

- Adapt or Die: From chalkboards to options trading, Sundar’s career pivots scream one thing: stay hungry, stay learning.

At Finosauras, we’re about cutting the BS. No ₹20 lakh “secret strategies”. Just raw data, transparent analysis, and tools to help you trade smarter. Because in a world of finfluencer theatrics, knowledge is the only flex that lasts.

Read Next: Life of Ashish Kacholia

Read Next: Minish Patel Portfolio Secrets