Let’s get real for a second. You’re here because you’ve heard options can do two things:

- Make you money when stocks go up, down, or sideways.

- Protect your portfolio from turning into a dumpster fire during crashes.

But let’s be honest—options can feel like decoding some hieroglyphics. Calls, puts, straddles, the Greeks… what even is a “theta”? And why does everyone on YouTube make it sound like you’ll retire by next Tuesday?

The truth is, options aren’t magic. They’re tools. Like a Swiss Army knife, they can save your butt or slice your fingers if you’re careless.

Want to hedge your Tesla shares before earnings? Done. Generate monthly income from that boring ETF you own? Easy. Bet on Netflix crashing without shorting? Yep, options can do that.

But yes, you will need a PLAN. Randomly buying calls is like throwing darts blindfolded. This guide? It’s your roadmap. We’ll start slow, then dive into strategies that match your goals.

By the end, you’ll know how to:

- Turn market chaos into steady income.

- Sleep better at night, even if stocks nosedive.

- Avoid the 7 deadly sins of option trading (yes, FOMO is one).

Let’s trade.

Looking to create a trading account? Read our practical guide on Top 10 Trading Apps India 2025.

Option Trading Strategies PDF📄

Get our detailed guide—Option Trading Strategies PDF. This PDF will be updated and you will be notified here.

TL;DR Here are the 10 option trading strategies in this article.

- Covered Calls strategy

- Protective Puts strategy

- Cash-Secured Puts strategy

- Collar strategy

- Iron Condor strategy

- Butterfly Spread strategy

- Calendar Spread strategy

- Straddle/Strangle strategy

- Naked Puts/Calls strategy

- Backspreads strategy

Foundational Concepts for Option Trading Strategies

Before we deep dive into strategies, let’s learn the basics.

1. Calls vs. Puts: The Yin and Yang

Calls

- What They Are: Think of a call option like a coupon that lets you buy a stock at a fixed price.

- Notation: NFLX 150 CE (Call European)

- Example: Suppose Netflix (NFLX) is trading at ₹180. You hold a NFLX 150 CE. This means you can buy Netflix at ₹150, locking in a ₹30 profit per share (₹180 – ₹150). Use calls if you’re bullish or need to hedge a short position.

Puts

- What They Are: Puts are like insurance for your stocks, paying you if the stock crashes.

- Notation: NFLX 150 PE (Put European)

- Example: Suppose Netflix (NFLX) is trading at ₹170. You hold a NFLX 200 PE. This allows you to sell Netflix at ₹200, giving you a ₹30 profit per share (₹200 – ₹170).Use puts if you’re bearish or if you own the stock and want downside protection.

Pro Tip: Buying calls/puts = Limited risk (you can only lose the premium). Selling them = unlimited risk.

Premium? It is the price you pay (as a buyer) or receive (as a seller) for an option. It’s determined by two components:

- Intrinsic Value:

- Calls: Stock Price - Strike Price (if stock > strike).

- Puts: Strike Price - Stock Price (if strike > stock).

- Extrinsic Value: Time + volatility + interest rates.

Calculating Intrinsic Value

For Calls:

- Intrinsic Value = Current Stock Price − Strike Price (if stock price > strike price )

Example: If Netflix (NFLX) is at ₹200 and you hold a ₹150 call:

₹200− ₹150 = ₹50 intrinsic value.

For Puts:

- Intrinsic Value = Strike Price - Current Stock Price (if strike > stock).

Example: If Intel (INTL) drops to ₹80 and you hold a ₹120 put:

₹120 - ₹80 = ₹40 Intrinsic Value.

If an option has no intrinsic value, it’s “OTM—out of the money” and priced purely on extrinsic value.

2. Strike Price & Expiration

Strike Price in Option Trading

- Strike Price is the “deal price” you lock in when you enter an option.

- Key Points:

- In-the-Money (ITM):

- Calls: Strike is below the current stock price.

- Puts: Strike is above the current stock price.

- At-the-Money(ATM)

- The strike price is equal(or close) to the current stock price

- They have the highest time value

- Out-of-the-Money (OTM):

- Cheaper but riskier—needs a big move in the stock price to be profitable.

- In-the-Money (ITM):

Expiration in Option Trading

- Expirations: It is the date by which your option must be used or it becomes worthless.

- Time Frames:

- Weekly Expiries (0-7 days):

- Extremely low cost but with rapid time decay

- Shorter Expiries (1-30 days):

- Lower cost but time decay is rapid.

- Longer Expiries (60+ days):

- Higher premium but gives your trade more time to work.

- Weekly Expiries (0-7 days):

Rule of Thumb: OTM options are like lottery tickets—cheap but require a big move, whereas ITM options cost more but behave more like the stock itself.

3. The Greeks in Option Trading

Options are influenced by “Greeks,” which help you understand how they behave:

Delta in Option Trading

- What It Does: Measures how much the option’s price moves with a ₹1 change in the stock.

- Example: An option with a delta of 0.6 gains roughly ₹0.60 for every ₹1 increase in the stock price.

Theta in Option Trading

- What It Does: Represents time decay—the silent killer.

- Example: Think of it as a melting ice cube: your option loses a bit of value each day, and this loss accelerates as expiration nears.

Vega in Option Trading

- What It Does: Measures sensitivity to market volatility.

- Example: If an option has high vega, its price might jump significantly if volatility spikes—especially useful to know around earnings season.

Fun Fact: As we get closer to the expiry date, whether its monthly or weekly, theta decay accelerates fast. That means options lose value faster as they are near expiration. y, so consider selling options near expiry or buying them earlier to mitigate rapid time decay.

4. Risk Management: Your Secret Weapon

Most traders fail because they ignore risk. Here’s how to protect your capital:

- Position Sizing: Never risk more than 1-2% of your account on a single trade.

- Stop-Losses: Set a “walk away” point. Example: “If I lose Rs5000 on this trade, I’m out.”

- Implied Volatility (IV):

- High IV: Options are expensive.

- Low IV: Options are cheaper. Always check the IV rank before entering a trade—think of it as your “discount meter.”

> Golden Rule: Trading without risk management is like skydiving without a parachute. Sure, you’ll fly... until you don’t.

Before You Dive Into Strategies...

So far, we've covered the foundational concepts of options trading.

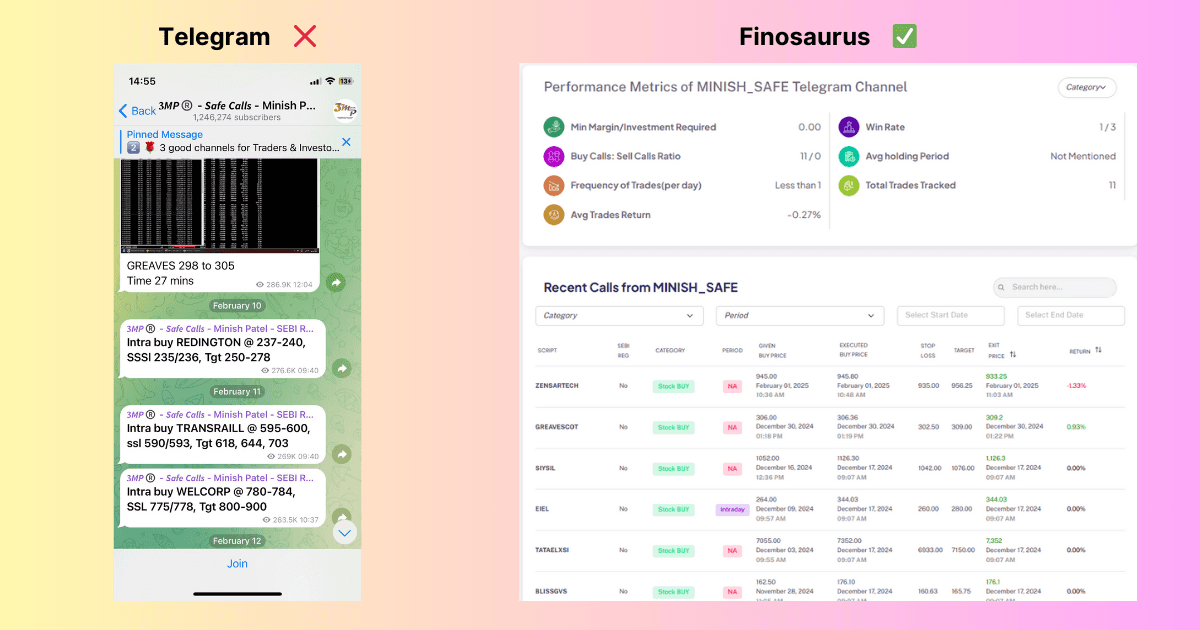

But let's be real — if you're trading in India, chances are you've spent some time on Telegram following influencers or joining trading groups. Many traders rely on these Telegram channels for trade tips, believing they're getting inside information or expert advice.

However, this is where things can get tricky...

Why Telegram Alone Isn’t Enough for Options Trading Insights

Many Telegram channels push rapid-fire calls, leaving you scrambling to decide whether to act. But here’s the problem:

❓ How accurate are these tips? ❓ What’s the win rate? ❓ Is the advisor reliable or just guessing?

Most Telegram channels provide little-to-no transparency on hit rates, ROI, or track records — making it tough to separate noise from valuable insights.

Where Finosauras Makes the Difference

That’s where Finosauras steps in. Instead of blindly following calls, Finosauras helps you track verified data and performance metrics from multiple Telegram trading channels.

- Performance Tracking: See how often a channel’s calls actually succeed.

- Clear Metrics: View detailed ROI, win rates, and trade performance history.

- Standardized Data: Finosauras corrects ticker errors, standardizes entry prices (even if given in ranges), and calculates clear stop loss and target prices based on logical percentages.

Integrating Finosauras with Your Options Strategy

Whether you're testing Covered Calls, Protective Puts, or speculative trades like Straddles, Finosauras can help you:

➡️ Spot Reliable Advisors. ➡️ Filter High-Risk Calls that don't align with your risk management plan. ➡️ Market Trends Details by cross-checking multiple channels.

Trading Tip: Use Finosauras to find advisors with a strong track record in the strategy you're following — this adds an extra layer of confidence to your trades.

Now let’s deep dive into the option trading strategies.

Conservative Option Trading Strategies (Income/Protection)

1. Covered Calls Option Trading Strategy

Objective: Earn extra income from stocks you already own. Best For: Long-term investors holding Nifty 50 stocks like Reliance or TCS who want monthly income.

When to Use Covered Calls Option Trading Strategy?

- Sideways markets (e.g., Infosys stuck between ₹1,400–₹1,500).

- High IV Rank (like during RBI policy uncertainty).

- To reduce cost basis (lower breakeven on your shares).

The Setup—How to Execute Covered Calls Option Trading Strategy

Step 1: What You Need

- 100 shares of a stock (e.g., Reliance Industries).

- A trading app with a brokerage account with options access (Zerodha, Upstox).

Step 2: Pick Your Strike Prices

- Simplified Rule: Choose a strike 3-5% above the current price.

- Example: Reliance at ₹1,248 → Sell ₹1,260 CE (3% OTM)..

Pro Tip: Check the stock’s 1-year high to avoid assignment.

Step 3: Choose Expiration

- Timeframe: 1 month (aligned with monthly expiry cycles).

Step 4: Risk vs. Reward

- Max Profit: Premium + (Strike - Stock Price if assigned).

- Example: Premium of ₹50/share → ₹5,000 per lot.

- Max Loss: Unlimited (if the stock crashes, but you still own shares).

- Breakeven: Purchase price of stock - premium.

NOTE: In options trading, contracts are purchased in lot sizes, not individual shares. Each company has its own predefined lot size.

When to Avoid Covered Calls Option Trading Strategy?

🚩 Pre-earnings season (e.g., TCS results next week → avoid!). 🚩 Low liquidity (e.g., small-cap stocks with wide bid-ask spreads). 🚩 You’re bullish long-term (don’t cap upside on multibaggers!).

✅ Pros

- Earn ₹3k–5k/month safely

- Low stress (holds like FD)

❌ Cons

- Miss rallies (e.g., Adani jumps 20% in a session)

- Requires ₹2–3L capital for 1 lot (e.g., Reliance)

Risk Management Tips for Covered Calls Option Trading Strategy

- Stick to large-caps (HDFC Bank, ITC)—less gap risk.

- Roll up strikes if the stock rises (e.g., Reliance hits ₹2,900 → close ₹2,940 call, sell ₹3,050).

- Avoid F&O expiry week—volatility spikes prices.

Real-World Example

Stock: SBI @ ₹721.75 Trade Details:

- BUY SBI Futures @ ₹722 (acts like holding the stock)

- SELL SBI 750 CE (Call Option) @ ₹13

- Lot Size: 750 shares

Premium Earned = ₹13 × 750 = ₹9,750

Outcomes & Scenarios

- If SBI closes ≤ ₹750 → You keep the full premium of ₹9,750 (1.8% return in a month).

- If SBI closes > ₹750 → Your shares will be sold at ₹750. Profit Calculation: (₹750 - ₹722) × 750 + ₹9,750 = ₹21,000

- If SBI crashes below ₹721.75 → Your loss mimics SBI’s price fall, but the ₹9,750 premium will reduce your losses.

Breakeven Price: ₹722 - ₹13 = ₹709

2. Protective Puts Option Trading Strategy

Objective: Protect your stock holdings from crashes without selling. Best For: Long-term investors in volatile stocks (e.g., Adani Enterprises, Tata Motors).

When to Use?

- Bearish short-term outlook (e.g., pre-budget volatility).

- Holding stocks with event risk (e.g., RIL before AGM).

- Sleep better during corrections (Nifty support breaks).

The Setup – How to Execute Protective Puts option trading strategy

Step 1: What You Need

- 100 shares of a stock (e.g., TCS @ ₹3,500).

- Enough capital to buy put options (₹5,000–₹10,000 per lot).

Step 2: Pick Strike Price

- Simplified Rule: Buy puts 5-10% below current price.

- Example: TCS at ₹3,500 → Buy ₹3,300 put (6% downside buffer).

Pro Tip: Use the stock’s 200-day moving average as a floor.

Step 3: Choose Expiry

- Timeframe: 1-3 months (matches your worry window).

Step 4: Risk vs. Reward

- Max Profit: Unlimited (stock can rally freely).

- Max Loss: Premium paid (e.g., ₹200/share → ₹20,000 per lot).

- Breakeven: Stock price + premium (₹3,500 + ₹200 = ₹3,700).

When to Avoid Protective Puts option trading strategy?

🚩 Stable blue chips (e.g., HUL – waste of premium). 🚩 Low IV (puts are overpriced; check IV Rank < 30). 🚩 You’re day trading (this is for holders, not gamblers).

✅ Pros

- Peace of mind during crashes

- No limit on upside gains

❌ Cons

- Costs money (like car insurance)

- Puts expire worthless if stock stays flat

Risk Management Tips for Protective Puts option trading strategy

- Pair with stocks you’ll hold 5+ years (don’t insure day-trade stocks).

- Roll puts down if stock falls (e.g., TCS drops to ₹3,200 → buy ₹3,100 put).

- Avoid OTM puts for critical support (e.g., buy ATM puts for 5% protection).

Real-World Example Protective Puts option trading strategy

Stock: Infosys @ ₹1,569.90

Trade:

- Buy 1 lot (400 shares) of Infosys Futures at ₹1,584.4

- Buy 1 lot (400 shares) ₹1,500 Put expiring on 24th April for ₹50 premium

Possible Outcomes

- If Infosys ≥ ₹1,584.4:

- Futures Gain: Unlimited

- Put Option Expires Worthless (Loss ₹20,000)

- If Infosys Crashes to ₹1,500:

- Futures Loss: ₹1,584.4 – ₹1,500 = ₹84.4 loss per share

- Total Loss in Futures: ₹84.4 × 400 = ₹33,760

- Put Option Pays Out: ₹1,500 – ₹1,500 = ₹0 (Break-even on the put)

- Net Loss = ₹33,760 + ₹20,000 (premium paid) = ₹53,760

- If Infosys Crashes to ₹1,450:

- Futures Loss: ₹1,584.4 – ₹1,450 = ₹134.4 loss per share

- Total Loss in Futures: ₹134.4 × 400 = ₹53,760

- Put Option Pays Out: ₹1,500 – ₹1,450 = ₹50

- Total Payout on Put: ₹50 × 400 = ₹20,000

- Net Loss = ₹53,760 – ₹20,000 = ₹33,760

Breakeven Point

- Breakeven = Futures Entry Price – Put Premium

- ₹1,584.4 – ₹50 = ₹1,534.4

3. Cash-Secured Puts Option Trading Strategy

Objective: Earn premium while waiting to buy stocks at your target price. Best For: Investors eyeing stocks like HDFC Bank or Asian Paints but waiting for dips.

When to Use?

- Bullish but patient (want to buy HDFC Bank at ₹1,600, not ₹1,700).

- High IV environments (earn extra premium during fear).

- Sideways markets (Nifty stuck in a range).

The Setup – How to Execute Cash-Secured puts option trading strategy

Step 1: What You Need

- Cash = Strike Price × Lot Size (e.g., ₹1,600 × 500 HDFC shares = ₹8L).

- Margin-enabled account (Zerodha/Upstox).

(You should understand with your broker about margin and the interest rate on them)

Step 2: Pick Strike Price

- Simplified Rule: Choose a strike 5-10% below current price.

- Example: HDFC Bank at ₹1,700 → Sell ₹1,600 put.

- Pro Tip: Align with Fibonacci retracement levels (e.g., 61.8% of rally).

Step 3: Choose Expiry

- Timeframe: 30-45 days (premiums decay fastest).

Step 4: Risk vs. Reward

- Max Profit: Premium earned (e.g., ₹40/share → ₹20k for HDFC lot).

- Max Loss: Stock crashes below strike (you buy at strike, but stock is lower).

- Breakeven: Strike Price – Premium (₹1,600 – ₹40 = ₹1,560).

When to Avoid Cash-Secured puts option trading strategy?

🚩 Bear markets (don’t catch falling knives). 🚩 Illiquid stocks (e.g., small-caps – exiting is a nightmare). 🚩 You don’t like the stock (never sell puts on stocks you won’t hold).

✅ Pros

Earn income while waiting

Buy stocks cheaper

❌ Cons

Requires big capital (₹8L for HDFC lot)

Still risky if market crashes 20%+

Risk Management Tips for Cash-Secured puts option trading strategy

- Stick to large-caps (e.g., HDFC, Kotak – less likely to collapse).

- Keep cash ready (brokers auto-debit if assigned).

- Roll puts down if stock nears strike (e.g., HDFC at ₹1,620 → close ₹1,600 put, sell ₹1,550).

Real-World Example for Cash-Secured puts option trading strategy

Asian Paints Stock Price: ₹2,251.30 Strike Price: ₹2,100 Lot Size: 200 shares Premium Earned: ₹50 per share

Trade Setup

- Step 1: Sell 1 lot (200 shares) of ₹2,100 Put Option expiring on 24th April.

- Step 2: Premium Earned = ₹50 × 200 = ₹10,000.

- Step 3: Margin Required ≈ ₹52,704.

Outcomes

✅ If Asian Paints stays above ₹2,100: → You keep the full ₹10,000 premium as profit.

❗ If Asian Paints drops below ₹2,100: → You must buy 200 shares at ₹2,100. → Effective cost per share = ₹2,100 – ₹50 (premium) = ₹2,050.

4. Collar Strategy

Objective: Limit downside risk and upside potential for near-zero cost. Best For: Investors holding volatile stocks through uncertain times.

When to Use Collar Strategy?

- Holding through elections or global crises (2024 Lok Sabha elections).

- Locking in gains (e.g., Tata Motors doubled; protect profits).

- Low-cost hedging (use call premium to fund puts).

The Setup – How to Execute Collar Option Trading Strategy

Step 1: What You Need

- 100 shares (e.g., Tata Steel @ ₹120).

- Capital to buy puts & sell calls (offsets cost).

Step 2: Pick Strikes

- Put: 5-10% below current price (e.g., ₹110).

- Call: 5-10% above (e.g., ₹130).

- Pro Tip: Match call premium to put cost (e.g., ₹5 call premium funds ₹5 put).

Step 3: Choose Expiry

- Timeframe: 2-3 months (covers event risk).

Step 4: Risk vs. Reward

- Max Profit: (Call Strike – Stock Price) + Premiums.

- Example: Stock at ₹120 → Max profit = ₹130 – ₹120 = ₹10 + ₹5 premium = ₹15.

- Max Loss: (Stock Price – Put Strike) – Premiums.

- ₹120 – ₹110 = ₹10 – ₹5 = ₹5.

- Breakeven: Stock Price – (Put Cost – Call Premium).

When to Avoid Collar Option Trading Strategy?

🚩 Bull markets (capping upside on multibaggers hurts). 🚩 Low volatility (can’t fund puts with cheap calls). 🚩 Penny stocks (illiquid options ruin the strategy).

✅ Pros

Nearly free downside protection

No emotional stress

❌ Cons

Sacrifice upside beyond call strike

Complex for beginners

Risk Management Tips for Collar Option Strategy

- Use on stocks you plan to sell soon

- Avoid dividend stocks (assignment risk on calls around ex-date).

- Close early if the stock breaches the call strike (don’t wait for expiry).

Real-World Example

Stock: Tata Motors @ ₹668.30 Lot Size: 550 shares

Trade Setup

- Buy ₹630 Put @ ₹11 (Protection)

- Sell ₹700 Call @ ₹15.8 (Income)

- Net Credit: ₹15.8 – ₹11 = ₹4.8/share = ₹2,640 (Total Credit)

Outcomes

- Stock Stays Between ₹630 – ₹700 ➡️ You keep your Tata Motors shares. ➡️ Profit: ₹2,640 from net credit.

- Stock Falls Below ₹630 ➡️ Your losses are capped at ₹630. ➡️ Total Loss Calculation: ₹668.30 – ₹630 = ₹38.3 – ₹4.8 (Credit) = ₹33.5/share ➡️ Total Loss: ₹33.5 × 550 = ₹18,425

- Stock Rises Above ₹700 ➡️ Your shares are sold at ₹700. ➡️ Profit Calculation: ₹700 – ₹668.30 = ₹31.7 + ₹4.8 (Credit) = ₹36.5/share ➡️ Total Profit: ₹36.5 × 550 = ₹20,075

Neutral Option Trading Strategies (Profit from Sideways Markets)

1. Iron Condor Option Trading Strategy

Objective: Profit when a stock or index trades in a tight range. Best For: Traders expecting low volatility (e.g., Nifty 50 pre-results season).

When to Use?

- Sideways markets (e.g., Nifty stuck between 22,500–23,000).

- Low IV Rank (volatility is cheap).

- Earnings overhang cleared (no major events for 30–45 days).

The Setup – How to Execute Iron Condor Option Trading Strategy

Step 1: What You Need

- Margin for spreads (₹50k–₹1L per lot).

- Index or liquid stock (Nifty, Bank Nifty, Reliance).

Step 2: Pick Strikes

- Sell OTM Call & Put: 2–3% away from current price.

- Example: Nifty at 17,800 → Sell 18,200 call & 17,400 put.

- Buy Further OTM Call & Put: 1% beyond sold strikes.

- Example: Buy 18,300 call & 17,300 put.

- Pro Tip: Keep wings 500–700 points apart on Nifty.

Step 3: Choose Expiry

- Timeframe: 30–45 days (time decay works in your favor).

Step 4: Risk vs. Reward

- Max Profit: Net premium (e.g., ₹8,000–₹12,000 per lot).

- Max Loss: Width of wings – net premium (e.g., ₹10,000 – ₹8,000 = ₹2,000).

- Breakeven: Upper/Lower strikes ± net premium.

When to Avoid Iron Condor Option Trading Strategy?

🚩 Elections/RBI meetings (volatility spikes kill profits). 🚩 Illiquid stocks (e.g., Vodafone Idea – wide spreads eat returns). 🚩 You’re greedy (don’t widen wings for extra ₹500; risk isn’t worth it).

✅ Pros

- Limited risk, defined profit

- Works in boring markets

- Require relatively low margin

❌ Cons

- Needs constant monitoring

- Small profits (2–4% per month)

Risk Management Tips for Iron Condor Option Trading Strategy

- Adjust wings if index nears strikes (e.g., Nifty at 18,150 → roll call up to 18,500).

- Close early at 50% profit (don’t wait for expiry).

- Avoid F&O expiry week – gamma risk spikes.

Real-World Example

Index: Bank Nifty @ 48,056.65 Trade:

- Sell ₹48,500 Call @ ₹426

- Sell ₹47,500 Put @ ₹442

- Buy ₹48,800 Call @ ₹307

- Buy ₹47,200 Put @ ₹218.6

Net Premium Collected: ₹5,832

Outcomes:

- Bank Nifty between ₹47,500 – ₹48,500: You keep ₹5,832 premium.

- Bank Nifty breaches ₹48,800 or ₹47,200: Max loss capped at ₹3,168.

2. Butterfly Spread Option Trading Strategy

Objective: Profit if a stock lands exactly at a target price. Best For: Traders with a strong view on a stock’s expiry price

When to Use?

- Pinballing around a level (e.g., Reliance ₹2,800 ± ₹20).

- Post-earnings stagnation (e.g., HUL after results).

- Low IV (cheap to set up).

The Setup – How to Execute Butterfly Spread Option Trading Strategy

Step 1: What You Need

- Capital for 3-leg trade (~₹15k–₹30k).

- Stock with weekly/monthly options (e.g., ITC).

Step 2: Pick Strikes

- Sell 2x ATM options: Center of the butterfly.

- Buy 1x ITM & 1x OTM: Wings.

- Example: ITC @ ₹450 → Buy ₹440 put, sell 2x ₹450 puts, buy ₹460 put.

- Pro Tip: Use ₹10 strike intervals for liquidity.

Step 3: Choose Expiry

- Timeframe: 7–15 days (needs precise timing).

Step 4: Risk vs. Reward

- Max Profit: Strike width – net debit (e.g., ₹10 – ₹2 = ₹8/share).

- Max Loss: Net premium paid (e.g., ₹2,000).

- Breakeven: Lower/Upper strikes ± net debit.

When to Avoid?

🚩 Volatile stocks (e.g., Adani Ports – too unpredictable). 🚩 Newbies (complex to manage). 🚩 High IV (expensive to set up).

✅ Pro

- High reward if stock pins strike

- Low capital needed

❌ Cons

- Tiny profit window (₹10–₹20 range)

- High brokerage costs (3 legs)

Risk Management Tips

- Set price alerts for the center strike.

- Close at 80% profit—don’t be greedy.

- Avoid OTM wings—liquidity dries up.

Real-World Example

Stock: SBI @ ₹723.05 Trade: ✅ Buy ₹710 put @ ₹6.5 ✅ Sell 2x ₹720 puts @ ₹9 each ✅ Buy ₹730 put @ ₹14.6 Net Debit: ₹1.3/share (₹975 per lot).

Outcomes: 📊 SBI closes at ₹720: Profit ₹8.7/share (₹6,525). 📉 SBI at ₹710 or ₹730: Break even. ❗ SBI outside ₹710–₹730: Lose ₹975.

3. Calendar Spread Option Trading Strategy

Objective: Profit from time decay differences between expiries. Best For: Patient traders eyeing stocks like Infosys post-results.

When to Use Calendar Spread Option Trading Strategy?

- Gradual price moves expected (e.g., HDFC Bank after RBI policy).

- High IV in near-term (sell expensive weekly options, buy cheap monthly).

- Earnings done (e.g., TCS post-Q3 results).

The Setup – How to Execute Calendar Spread Option Trading Strategy

Step 1: What You Need

- Margin for short leg (Zerodha/Upstox).

- Stock with weekly & monthly options.

Step 2: Pick Strikes

- Sell near-term ATM option.

- Buy longer-term same strike.

- Example: Sell weekly ₹1,000 call, buy monthly ₹1,000 call.

- Pro Tip: Match deltas (e.g., 0.5) to hedge directional risk.

Step 3: Choose Expiry

- Timeframe: Sell 1-week, buy 1-month.

Step 4: Risk vs. Reward

- Max Profit: Net credit + time decay difference.

- Max Loss: Unlimited (if stock rockets past strike).

- Breakeven: Depends on volatility crush.

When to Avoid Calendar Spread Option Trading Strategy?

🚩 Earnings week (IV spikes ruin the play). 🚩 Low liquidity (e.g., PSU banks). 🚩 You can’t monitor daily (needs adjustments).

✅ Pros

- Profit even if stock doesn’t move

- Low directional risk

❌ Cons

- Complex adjustments needed

- Unlimited downside if wrong

Risk Management Tips for Calendar Spread Option Trading Strategy

- Roll short leg if challenged (e.g., stock nears strike → close weekly, sell next week).

- Pair with delta-neutral hedge (e.g., buy/sell shares).

- Avoid meme stocks (e.g., YES Bank – too unpredictable).

Real-World Example

Stock: Infosys @ ₹1,590.85 Trade:

- Sell weekly ₹1,580 call @ ₹40.25

- Buy monthly ₹1,580 call @ ₹71.9 Net Debit: ₹31.65 (₹12,660 per lot)

Outcomes:

✅ Infosys remains near ₹1,580:

- Weekly call expires worthless.

- Monthly call retains value.

- Profit: ₹8,333 (max profit).

📉 Infosys drops below ₹1,536 or rises above ₹1,637:

- Both calls lose value.

- Loss: Maximum ₹12,660.

💼 Breakeven Zones:

- Lower breakeven: ₹1,536

- Upper breakeven: ₹1,637

Key Tips for Managing the Trade:

- 🚨 Set an alert at ₹1,580; if breached, consider rolling the short call to the next week’s expiry.

- ⚠️ Monitor IV closely. If IV crashes too fast, close early to lock profits.

- ⏳ Time Value Focus: Aim to book 60–70% profit before expiry instead of waiting for full value.

4. Straddle/Strangle Option Trading Strategy

Objective: Profit from big price swings (up or down). Best For: Events like Budget, RBI policy, or Tata Steel earnings.

When to Use?

- High IV expected (e.g., pre-Budget speculation).

- Binary events (e.g., RIL AGM, IPO listings).

- VIX above 25 (volatility is the playground).

The Setup – How to Execute

> Straddle (Same Strike):

- Buy ATM Call & Put:

- Example: Nifty at 18,000 → Buy 18,000 call & put.

> Strangle (OTM Strikes):

- Buy OTM Call & Put (cheaper but needs bigger move):

- Example: Buy 18,500 call & 17,500 put.

Step 1: What You Need

- Capital for 2 options (₹10k–₹50k).

- High-conviction volatility play.

Step 2: Pick Strikes

- Straddle: ATM for maximum sensitivity.

- Strangle: 3–5% OTM to reduce cost.

Step 3: Choose Expiry

- Timeframe: 1–15 days (volatility events are short-lived).

Step 4: Risk vs. Reward

- Max Profit: Unlimited (stock moves sharply).

- Max Loss: Premium paid (e.g., ₹10,000).

- Breakeven: Stock price ± total premium.

When to Avoid Straddle/Strangle Option Trading Strategy?

🚩 Low IV environments (e.g., post-monsoon market lull). 🚩 You’re risk-averse (premiums can vanish fast). 🚩 Illiquid strikes (wide bid-ask spreads eat returns).

✅ Pros

- Win whether stock rises or falls

- No need to predict direction

❌ Cons

- High cost (like buying both car & bike insurance)

- Needs a big move (5%+) to profit

Risk Management Tips

- Buy 1–2 days pre-event (don’t hold through IV crush).

- Sell before the news (“Buy the rumor, sell the news”).

- Use strangles for cheaper bets (e.g., Budget day on Nifty).

Real-World Example

Event: RBI Policy Decision (Nifty @ ₹22,470.50) Trade:

- Buy 22,450 Call @ ₹269.3

- Buy 22,450 Put @ ₹197 Total Premium Paid: ₹466.3 per share Lot Size: 75 (Total Cost = ₹34,973)

Outcomes

➡️ Scenario 1: Nifty Moves Sharply Upwards (e.g., ₹22,900)

- 22,450 Call Value: ₹450 (₹22,900 – ₹22,450)

- 22,450 Put Value: ₹0 (Expires worthless) Net Profit: ₹450 – ₹466.3 = ₹(-16.3) per share Total Loss: ₹(-1,222.5)** (Slight loss if movement isn’t strong enough)

➡️ Scenario 2: Nifty Moves Sharply Downwards (e.g., ₹22,000)

- 22,450 Call Value: ₹0 (Expires worthless)

- 22,450 Put Value: ₹450 (₹22,450 – ₹22,000) Net Profit: ₹450 – ₹466.3 = ₹(-16.3) per share Total Loss: ₹(-1,222.5)** (Similar to the upside)

➡️ Scenario 3: Nifty Flat (e.g., ₹22,450 stays unchanged)

- Both call and put options expire worthless. Total Loss: ₹466.3 (Maximum loss scenario) Total Loss Amount: ₹34,973 (Premium paid)

Breakeven Points

- Downside Breakeven: ₹21,984

- Upside Breakeven: ₹22,916

Aggressive Option Trading Strategies (Leveraged Speculation)

1. Naked Puts/Calls Option Trading Strategy

Objective: Profit from premium decay with high leverage. Best For: Experienced traders with deep pockets and iron nerves. Not for beginners!

When to Use?

- Extreme confidence in direction (e.g., Nifty won’t drop below 18,000 this month).

- IV is sky-high (sell overpriced options during panic).

- Margin available in your trading account.

The Setup – How to Execute

Step 1: What You Need

- Heavy margin (₹5L+ for Nifty lot).

- Guts to handle unlimited losses (e.g., ₹10L+ on a bad day).

Step 2: Sell Naked Options

- Naked Put: Sell OTM put (bet stock won’t crash).

- Example: Sell ₹1,800 put on Reliance (current price ₹2,800).

- Naked Call: Sell OTM call (bet stock won’t moon).

- Example: Sell ₹700 call on ITC (current price ₹450).

Step 3: Expiry

- Timeframe: 7–15 days (premiums decay fastest).

Step 4: Risk vs. Reward

- Max Profit: Premium received (e.g., ₹20,000).

- Max Loss: Unlimited (stock can go to zero or infinity).

- Breakeven: Strike ± Premium (irrelevant – losses can snowball).

When to Avoid?

🚩 Low risk tolerance (you’ll panic if Reliance gaps down 10%). 🚩 Illiquid stocks (can’t exit even if you want to). 🚩 Market euphoria/crash phases (black swans kill naked sellers).

✅ Pros

- High premium income

- Simple setup

❌ Cons

- Margin calls can wipe out your account

- Sleep deprivation guaranteed

Risk Management Tips

- Set stop-loss at 2x premium (e.g., ₹20k profit target → ₹40k loss limit).

- Never allocate >5% capital to one trade.

- Hedge with futures (e.g., sell naked put on Reliance? Buy Reliance futures).

Real-World Example

Trade Execution

- Sell 1 Nifty 22,200 PUT (PE)

- Expiry: 27 March

- Premium Received: ₹112

- Lot Size: 75

- Total Premium Earned: ₹112 × 75 = ₹8,400

Outcomes

📈 If Nifty Closes Above ₹22,200 (Best Case)

- Full profit = ₹8,400

- Example: Nifty closes at ₹22,500 → PUT expires worthless → ₹8,400 profit.

📉 If Nifty Falls to ₹22,100 (Mild Downtrend)

- Loss Calculation: → Strike Price – Spot Price = ₹22,200 – ₹22,100 = ₹100 → ₹100 × 75 = ₹7,500 Loss

- Net P/L: ₹8,400 – ₹7,500 = ₹900 Profit

🚨 If Nifty Crashes to ₹21,800 (Danger Zone)

- Loss Calculation: → ₹22,200 – ₹21,800 = ₹400 → ₹400 × 75 = ₹30,000 Loss

- Net P/L: ₹30,000 – ₹8,400 = ₹21,600 Net Loss

⚠️ If Nifty Crashes to ₹21,500 (Worst Case)

- Loss Calculation: → ₹22,200 – ₹21,500 = ₹700 → ₹700 × 75 = ₹52,500 Loss

- Net P/L: ₹52,500 – ₹8,400 = ₹44,100 Net Loss

2. Ratio Spreads Option Trading Strategy

Objective: Profit from sideways moves with skewed risk-reward. Best For: Traders who think “This stock won’t move much, but if it does, I’m safe.”

When to Use Ratio Spreads Option Trading Strategy?

- Neutral bias with a hedge (e.g., HDFC Bank post-results).

- Low IV Rank (cheap to set up).

- Capital-efficient speculation (less margin than naked trades).

The Setup – How to Execute Ratio Spreads Option Trading Strategy

Step 1: What You Need

- Margin for short legs (₹1L–₹2L).

- Stock with liquid options (e.g., ICICI Bank).

Step 2: Sell More, Buy Less

- Call Ratio Spread: Sell 2x OTM calls, buy 1x ITM call.

- Example: ICICI @ ₹900 → Buy ₹880 call, sell 2x ₹920 calls.

- Put Ratio Spread: Sell 2x OTM puts, buy 1x ITM put.

Step 3: Expiry

- Timeframe: 30–45 days (needs time decay).

Step 4: Risk vs. Reward

- Max Profit: Limited (net premium + strike difference).

- Max Loss: Unlimited beyond short strikes.

- Breakeven: Complex—use options calculators.

When to Avoid Ratio Spreads Option Trading Strategy?

🚩 Volatile stocks (e.g., Adani Group—gaps wreck ratios). 🚩 You don’t understand Greeks (delta/gamma will haunt you). 🚩 Greedy strikes (don’t sell ₹1,000 calls on a ₹900 stock).

✅ Pros

- Low upfront cost

- Profit even if wrong

❌ Cons

- Unlimited risk beyond short strikes

- Complex adjustments needed

Risk Management Tips

- Cap short strikes at 10% OTM (e.g., ICICI @ ₹900 → ₹990).

- Roll short legs if tested (e.g., ICICI at ₹910 → close ₹920 calls, sell ₹940).

- Pair with VIX spikes (sell when IV is high).

Real-World Example

Stock: Axis Bank @ ₹1,011.20 Lot Size: 625 Expiry Date: 24 April 2025

Trade Setup: ✅ Buy 1x ₹980 PUT @ ₹19 ✅ Sell 2x ₹950 PUT @ ₹11 each Net Premium Received: ₹1,875

Outcomes:

1️⃣ Axis Bank closes above ₹980

- All options expire worthless.

- Profit: ₹1,875 (Full premium retained).

2️⃣ Axis Bank closes at ₹950

- Maximum Profit: ₹20,625

- Calculation: (₹980 - ₹950) × 625 = ₹18,750 (Intrinsic Value) + ₹1,875 (Premium Received).

3️⃣ Axis Bank crashes below ₹917

- Loss starts escalating beyond this point.

- Example: If Axis Bank falls to ₹900:

- Loss = [(₹950 - ₹900) × 625] - ₹1,875

- Loss: ₹28,125 - ₹1,875 = ₹26,250

3. Backspreads Option Trading Strategy

Objective: Profit from explosive moves with limited risk. Best For: Traders expecting black swan events (e.g., Yes Bank collapse).

When to Use?

- High volatility potential (e.g., Tata Motors before EV launch).

- Cheap IV (buying OTM options is affordable).

- Asymmetric risk-reward (small loss if wrong, 5x gain if right).

The Setup – How to Execute Backspreads Option Trading Strategy

Step 1: What You Need

- Capital for long legs (₹10k–₹50k).

- Stock with weekly/monthly options (e.g., Tata Steel).

Step 2: Buy More, Sell Less

- Call Backspread: Buy 2x OTM calls, sell 1x ITM call.

- Example: Tata Steel @ ₹120 → Sell ₹110 call, buy 2x ₹130 calls.

- Put Backspread: Buy 2x OTM puts, sell 1x ITM put.

Step 3: Expiry

- Timeframe: 15–30 days (needs time for the big move).

Step 4: Risk vs. Reward

- Max Profit: Unlimited if stock moons/crashes.

- Max Loss: Net debit (e.g., ₹5,000).

- Breakeven: Strike ± (net debit / number of contracts).

When to Avoid?

🚩 Low IV environments (OTM options too cheap). 🚩 Illiquid underlyings (e.g., PSU stocks). 🚩 Impatient traders (needs holding till D-Day).

✅ Pros

- Limited risk

- High reward potential

❌ Cons

- Needs a big move (10%+)

- Time decay kills OTM options

Risk Management Tips

- Use delta-neutral ratios (e.g., 2:1 for calls/puts).

- Close if IV crashes (e.g., post-earnings IV drop).

- Avoid penny stocks (no liquidity to exit).

Real-World Example

Stock: Tata Steel @ ₹150.30 Trade Setup: ✅ Sell 1x ₹140 PUT @ ₹2 ✅ Buy 2x ₹130 PUT @ ₹0.75 each Net Debit (Entry Cost): ₹2,750 (₹5,500 – ₹2,750)

Outcomes

1️⃣ Tata Steel stays above ₹140:

- All options expire worthless.

- Loss = ₹2,750 (Net Debit).

2️⃣ Tata Steel crashes to ₹110:

- Profit = (₹140 – ₹110) × 5500 – 2x [(₹130 – ₹110) × 5500] – Net Debit

- Profit Calculation:

(140-110) * 550 - 2 * [(130 - 110) * 5500] - 2750 = ₹1,65,000 - ₹2,20,000−₹2,750=−₹57,750

3️⃣ Tata Steel dips slightly (~₹145 to ₹140):

- Minimal impact, close to breakeven.

These were some strategies; in our next blog posts, we would cover some more advanced strategies like synthetic positions and spread and gamma scalping.

Option Trading Strategy Selection Framework

1. What’s Your Goal?

👉 Pick one:

- Income Generation → Go to Step 2

- Portfolio Protection → Go to Step 3

- Speculation/Quick Profits → Go to Step 4

- Sideways Market (Minimal Movement) → Go to Step 5

2. Income Generation Strategies

✅ Do you already own 100+ shares of a stock?

- Yes: → Use a Covered Call to generate steady income.

- No: → Use a Cash-Secured Put to earn premium while waiting to buy the stock at a lower price.

💡 Pro Tip: For stable income, pick options with 30-60 day expiries and OTM strike prices for higher success rates.

3. Portfolio Protection Strategies

✅ Are you worried about a market crash or sudden dip?

- Yes: → Use a Protective Put to insure your holdings.

- No, I’m just cautious: → Use a Collar (combine a put and covered call) for low-cost protection.

💡 Pro Tip: Protective strategies are best when volatility is low — premiums are cheaper.

4. Speculation/Quick Profit Strategies

✅ What’s your market outlook?

- Strong Bullish View: → Use a Long Call or Bull Call Spread.

- Strong Bearish View: → Use a Long Put or Bear Put Spread.

- Uncertain (Big Move Expected Either Way): → Use a Straddle or Strangle.

💡 Pro Tip: For speculative trades, pick shorter expiries (1-2 weeks) to minimize premium costs.

4. Sideways Market Strategies (Low Volatility)

✅ Are you confident the stock will stay in a range?

- Yes: → Use an Iron Condor or Calendar Spread for controlled risk and consistent gains.

- No, but I want limited risk: → Use a Butterfly Spread for a balanced risk-reward profile.

💡 Pro Tip: Sideways strategies work best when Implied Volatility (IV) is high — you'll sell options for inflated premiums.

Tools and Resources

Option Trading Strategies Books

While options can feel overwhelming at first, these books break down concepts into simple, actionable insights.

📚 Beginner-Friendly Reads

- “Options Made Easy” by Guy Cohen

- “Options as a Strategic Investment” by Lawrence G. McMillan

- “The Bible of Options Strategies” by Guy Cohen

📘 Advanced Reads for Experienced Traders

- “Option Volatility & Pricing” by Sheldon Natenberg

- “Trading Options Greeks” by Dan Passarelli

> Start with “Options Made Easy” if you’re a beginner — it’s concise and packed with real-world tips.

Option Trading Strategies Tools

- Sensibull (Best for Beginners) – Integrated with Zerodha, it offers an intuitive interface for building strategies, analyzing Greeks, and managing risk

- Opstra by Define Edge (Best for Technical Analysis) – Great for tracking option chains, analyzing IV charts, and setting alerts.

- Market Pulse (Best for Mobile Trading) – A mobile-first app with real-time data, option Greeks, and strategy building.

- Options Oracle (Best for Advanced Users) – Ideal for complex multi-leg strategies and analyzing risk-reward scenarios.

Option Trading Strategies Platforms

📈 Best for Beginners

- Zerodha – India's most popular platform with seamless Sensibull integration.

- Angel One – User-friendly interface with easy options chain access.

💼 Best for Active Traders

- Fyers – Great for charting, detailed market data, and custom indicators.

- Upstox – Offers lightning-fast order execution with solid options data.

⚙️ Best for Strategy Automation

- Tradetron – Allows automated trading with custom rule-based strategies.

- Streak by Zerodha – Automate entry/exit rules with zero coding knowledge.

💡 Pro Tip: If you're new, start with Zerodha + Sensibull. For power users, combine Opstra for analysis with Tradetron for automation.

Conclusion

Options trading can be rewarding, but the truth is—not everyone wins. Losses are part of the game, and success comes from managing them wisely.

Your Action Plan for Success

✅ Start with low-risk strategies like Covered Calls.

✅ Focus on learning key concepts like Greeks and IV.

✅ Use paper trading to practice before risking real money.

✅ Track your trades to understand what works best.

✅ Avoid chasing hype—research before you act.

🔥 Make Informed Trading Decisions with Finosauras.com

When exploring options strategies, it’s easy to get influenced by market tips and Telegram trade calls. But are they reliable?

With Finosauras, you can:

- Track the track record of trading advisors before following their tips.

- See verified data like ROI, win rates, and trade history to filter out unreliable advice.

- Spot high-potential strategies by analyzing real performance metrics from trusted sources.

Let Finosauras help you identify trusted insights—so you trade smarter, not harder.

👉 Start Trading Smarter with Finosauras!

Happy Trading!