Remember when trading meant calling a broker or just staring at your desktop? Today, your smartphone is all you need. The pandemic didn’t just change how we work—it reshaped how we invest. Between March 2020 and August 2024, trading app downloads in India skyrocketed by 47%, with over 7.2 million downloads in 2024 alone.

Why? Lockdowns gave us time, market dips gave us opportunities, and apps made it all this simple.

This listicle isn’t just another “top apps” roundup. We’ve handpicked 10 platforms that fit real needs—whether you’re a newbie testing the waters or a pro trader.

Let’s dive in!

How We Picked the Best Apps (No BS)

With 50+ trading apps flooding the market, picking the right one feels like finding a needle in a haystack. Here’s how we narrowed it down:

- “Can You Trade While Sipping Chai?” (Ease of Use) : Cluttered apps = frustration.

- “Will Fees Eat Your Profits?” (Costs) : Hidden charges? Nope. We highlighted apps with zero brokerage on equity trades and flat ₹20 fees for active traders.

- “Does It Do More Than Stocks?” (Variety) : Want ETFs, mutual funds, or even US stocks? We found apps that let you diversify like a pro.

- “Fancy Tools or Just Hype?” (Features) : Real-time charts, Trading insights, and dark mode? Yes, please.

- “Help! I’m Stuck!” (Support & Learning) : 24/7 chat/call support? Free courses? We prioritized apps that hand-hold you through the chaos.

- “Is My Money Safe?” (Security) : SEBI-regulated, 2FA logins, and encryption? Non-negotiable.

Complement Your Trade with Finosauras

Over 1.8 million traders flood Telegram channels daily for market tips. But here is the thing: 90% of these groups are either scams, hype machines, or run by self-proclaimed “experts” with zero credentials.

Finosauras cuts through the noise by:

- Aggregating 5,000+ Telegram channels (SEBI-registered telegram channels, influencers, and even shady pump-and-dump groups).

- Verifying tips against real-time market data and SEBI databases 13.

- Simulating trades to track ROI, win rates, and other important data.

Why Pair Finosauras with Trading Apps?

> Think of it like Netflix + IMDb. Your trading app (Zerodha, Upstox) executes trades; Finosauras tells you what to trade.

In a world where “90% of F&O traders lose money," the Finosauras platform turns that chaotic Telegram noise into actionable insights.

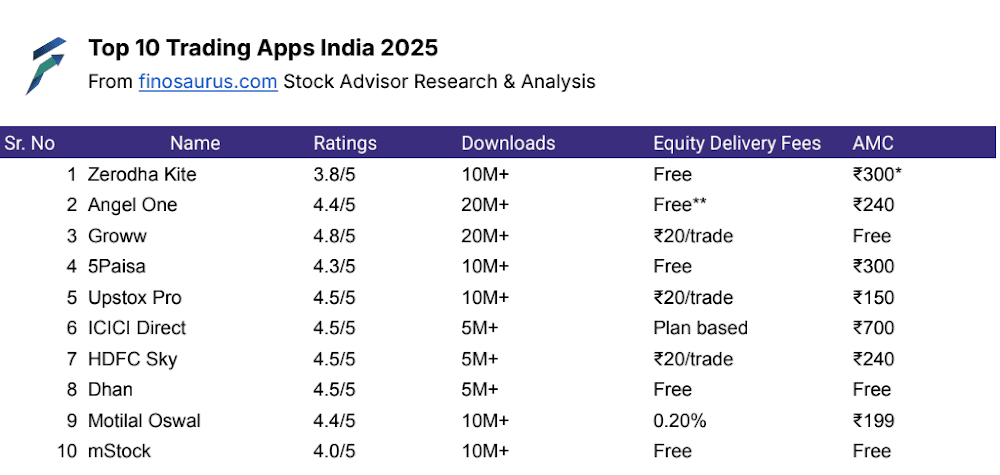

Top 10 Best Trading Apps in India (2025)

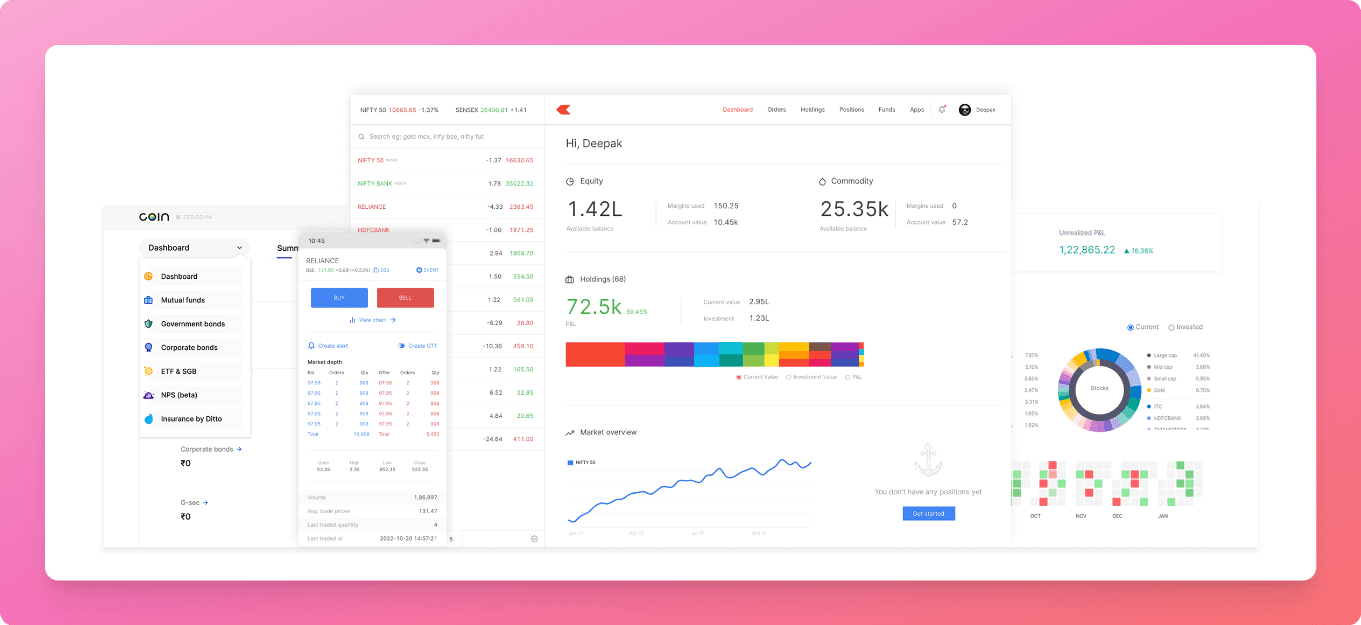

1. Zerodha Kite

Zerodha’s clean, no-frills UI (“like a trusty old scooter”) keeps long-term investors hooked—praised for instant withdrawals, tax reports, and reliability.

But Reddit threads roast it for being “glitchy AF” during market peaks, forcing day traders to rage-quit mid-trade. Splitting mutual funds (Coin) and trading (Kite) into separate apps annoys users (“Why can’t it be like Groww?!”), and missing features like trailing stop-loss or affordable API access (₹2k/month?!) push F&O traders toward Dhan or Shoonya.

While newbies love its simplicity, veterans call it “stuck in 2015” compared to rivals with AI tools or drag-n-drop trading. Zerodha’s still king for casual investing—just avoid it if you’re into making those trades fast.

As one user sums up: “Solid… till it crashes. 🤷♂️”

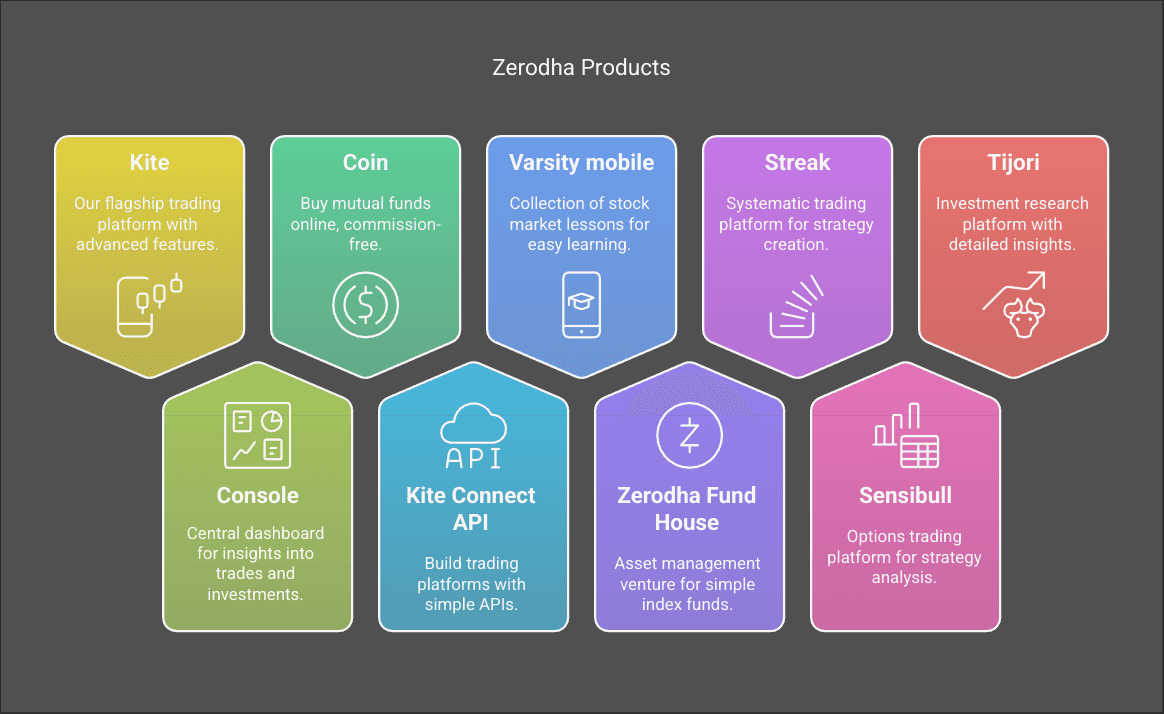

Zerodha's ecosystem is large; here are its other offerings.

Total Downloads - 10M+ Downloads

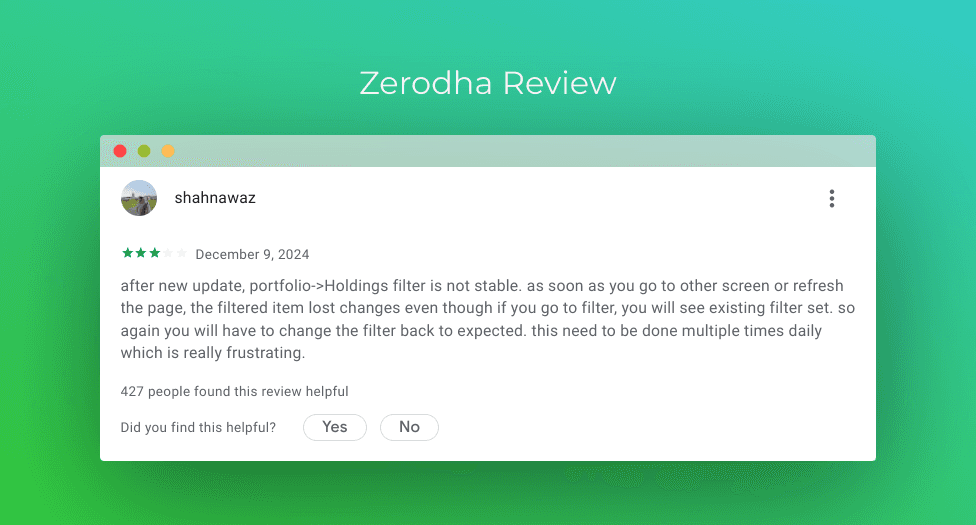

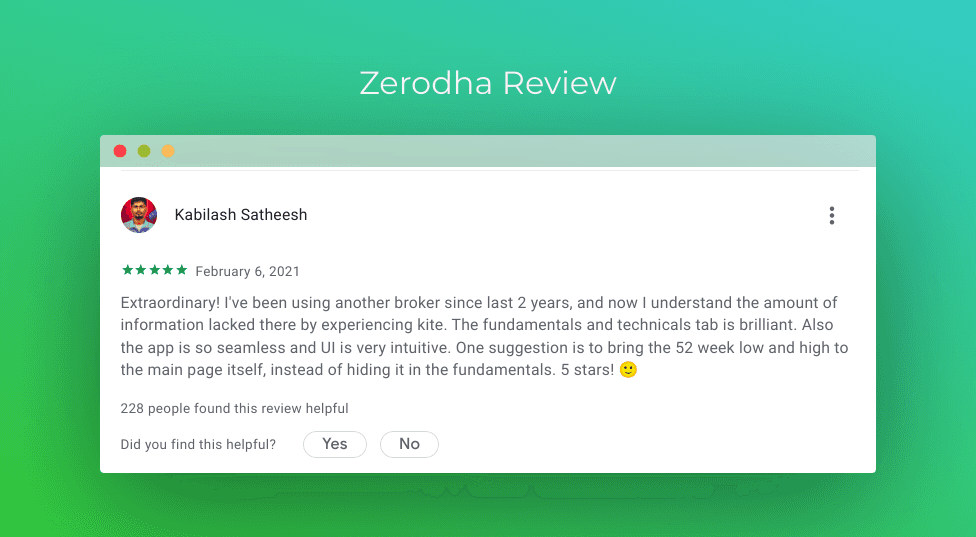

Zerodha Reviews (Overall 3.8/5 on PlayStore)

1 Star Review ⭐

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

Zerodha Key Features

- One-click orders: Place trades faster.

- Tax reports: Get yearly P&L statements and other statements via their console.

- Price alerts: Set triggers for stocks, F&O, or currencies.

- Baskets: Create multiple orders at once.

- Algo-trading: Automate strategies without coding using Streak.

Downside

- No demo account

- Customer support is only available on Weekdays

- No international stocks

Trading Instruments

- Stocks listed on NSE and BSE (via Kite).

- Futures & Options (F&O)

- Mutual Funds and NFO (via Coin)

- ETFs and SGB

- IPOs (via Kite)

- Currency derivatives

- Govt Securities

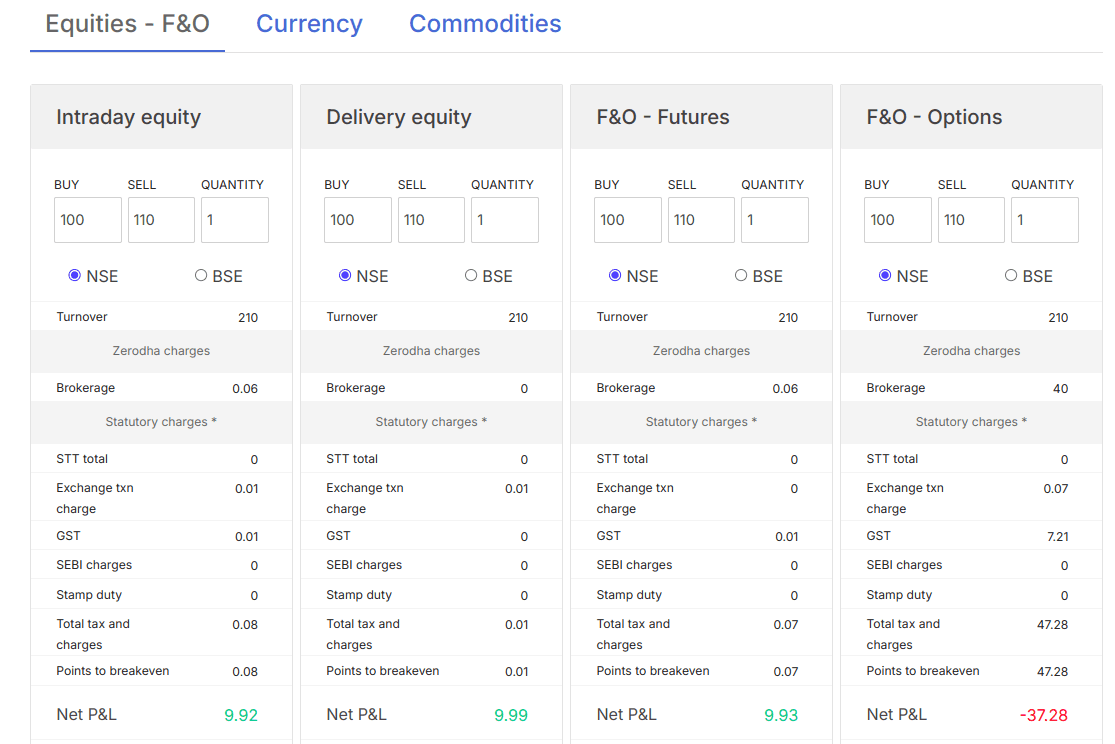

Zerodha Fees

- Equity Delivery Fee - ₹0 (Free!)

- Equity Intraday Fee - ₹20 or 0.03% (whichever is lower)

- FnO Fee - ₹20 or 0.03% (whichever is lower)

- Account Opening Fee - Free

- Demat AMC Fee - ₹0 for BSDA Account and ₹300 per year for non-BSDA Account.

Note: A BSDA (Basic Services Demat Account) is a no-frills demat account for small investors with reduced maintenance charges, available for holdings up to ₹2 lakh.

Let’s see fees in the real scenario if you are buying for ₹100 and selling for ₹110, 1 share.

2. Angel One

AngelOne suits advanced traders with tools like integrated TradingView charts and multi-asset access, though its cluttered UI challenges beginners. While praised for stability, users report spam calls and higher fees (₹20–40/trade) vs. rivals like Zerodha.

Verdict: Ideal for technical traders; casual investors may prefer Groww or m.Stock for simplicity.

Total Downloads - 20M+ Downloads

Angel One Review (4.4/5)

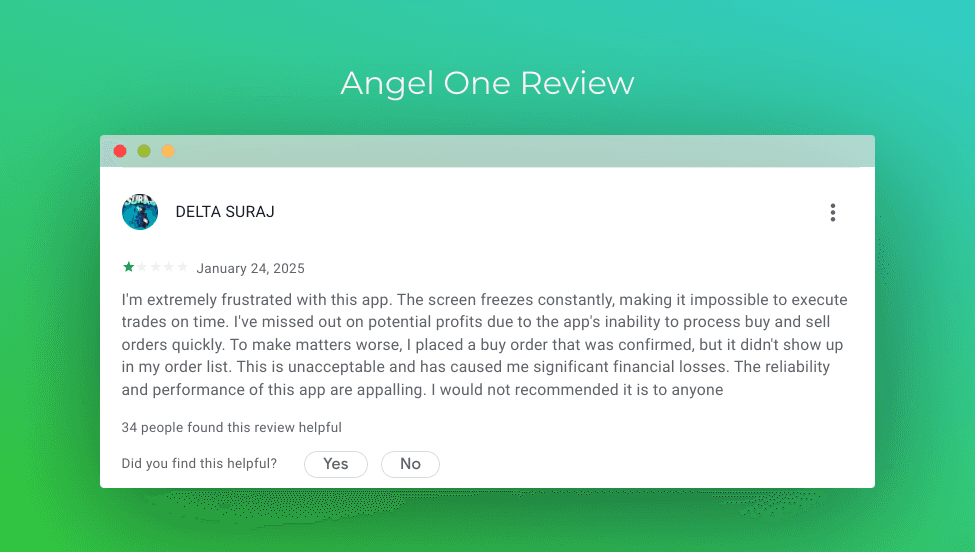

1 Star Review ⭐

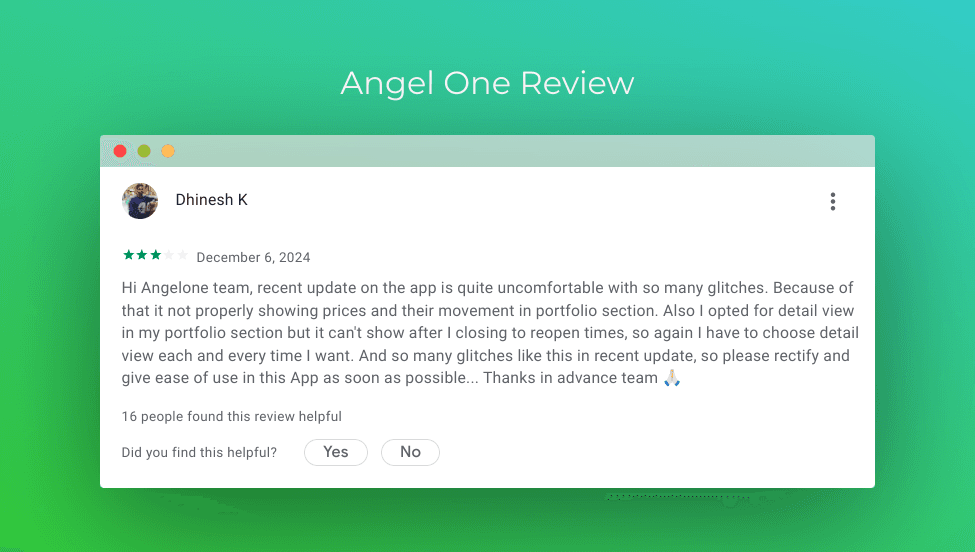

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

Angel One Features

- Fast Order Placements

- Advisory services so you look at portfolios built by experts.

- Referral rewards: Earn ₹500 per friend (if it’s an old account, you can even make ₹750 per referral).

- User-friendly web and mobile platforms with in-depth research tools

- Wide range of research and analysis tools

Downside

- Occasional cross-selling by relationship managers can be distracting

- Some users report technical glitches and slow responses at times

- Overwhelming mobile app

Trading Instruments

- Stocks and ETFs

- Mutual Funds and NFOs

- Futures & Options

- US Stocks / US ETFs

- Currencies and Commodities

- Bonds

Angel One Fees

- Equity Delivery Fee: Free. After the first 30 days the charge is ₹20 or 0.1% per executed order.

- Equity Intraday Fee: ₹0 for trades upto ₹500 for the first 30 days and after that ₹20 or 0.03% per executed order.

- FnO Fee: ₹20/trade or 0.25% of the

- Account Opening Fee: Free

- Demat AMC Fee: One year free. BSDA Account with value of holdings upto ₹4L, zero charges. ₹4L to 10L, ₹100 + GST/Year. Non-BSDA Clients, ₹60+GST/Quarter.

Let’s see fees in a real scenario if you are buying for ₹100 and selling for ₹110, 1 Share.

For Equity Charges

- Brokerage: ₹4.00

- Other Charges: ₹24.55

- Breakeven: ₹28.55

- Net P&L: ₹-18.55

For Equity - F&O

- Brokerage: ₹40.00

- Other Charges: ₹7.22

- Breakeven: ₹47.22

- Net P&L: ₹-37.22

For Currency

- Brokerage: ₹0.53

- Other Charges: ₹0.09

- Breakeven: ₹0.62

- Net P&L: ₹9.38

3. Groww

Groww is a favorite for beginners because it's really simple and feels more like shopping online than dealing with a complex trading app. Everything is laid out clearly, so you can start investing without getting overwhelmed.

Some users have mentioned that when trading stocks, the app can be a bit slow or act up when lots of people are using it, which can be annoying if you need to move fast.

Overall, if you're just starting out and want an easy, no-fuss way to invest, Groww is a great choice, but if you need more advanced features, you might want to explore other options.

Total Downloads - 20M+ Downloads

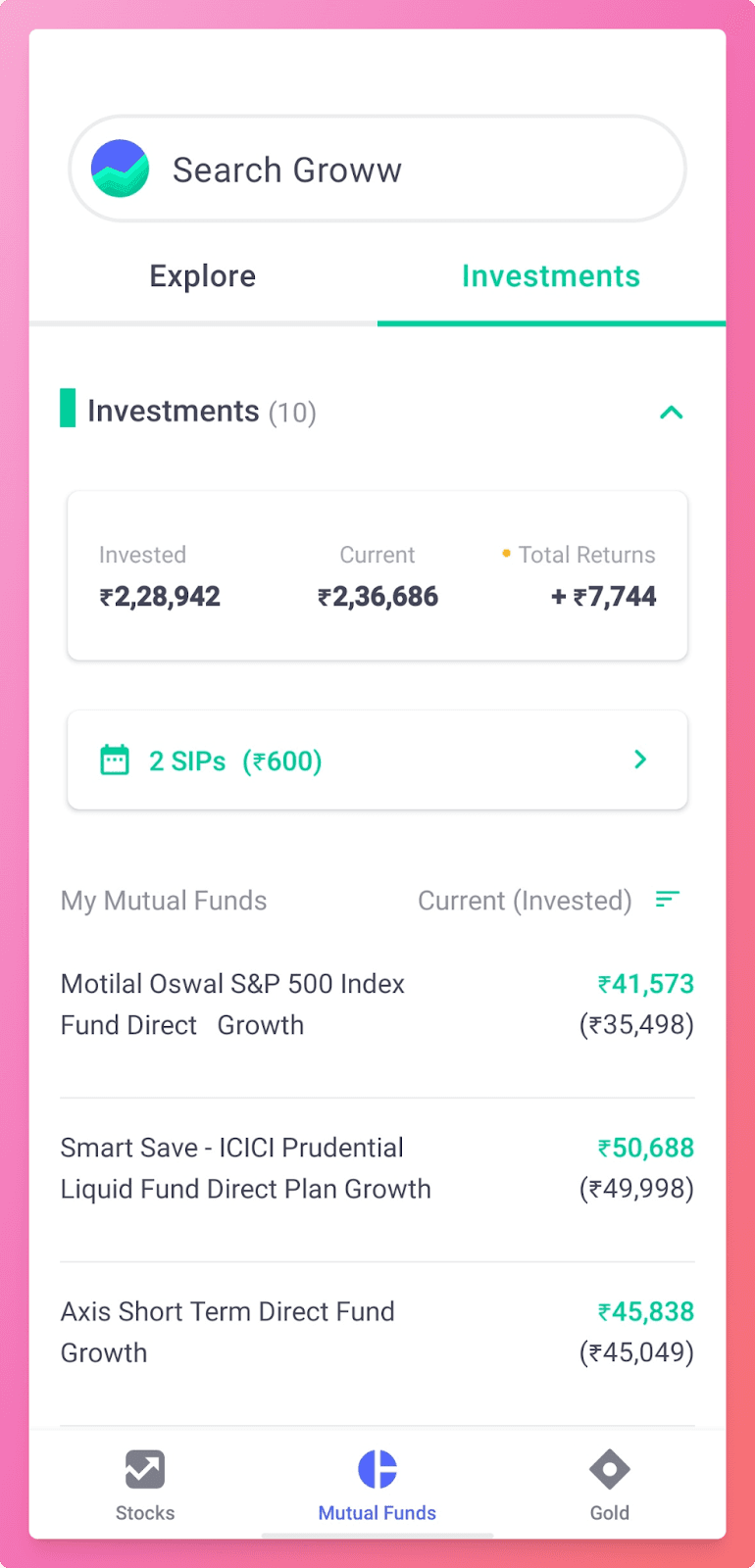

Groww Review (4.8/5)

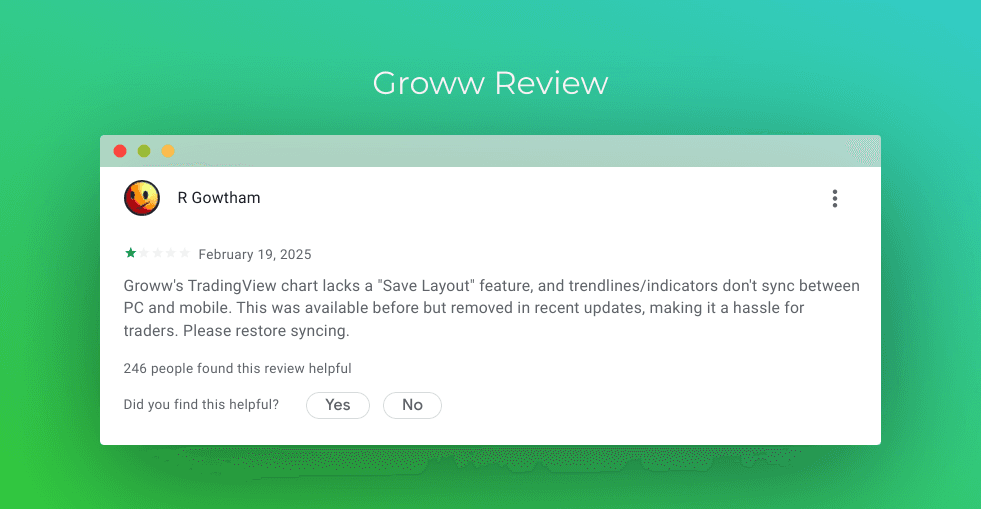

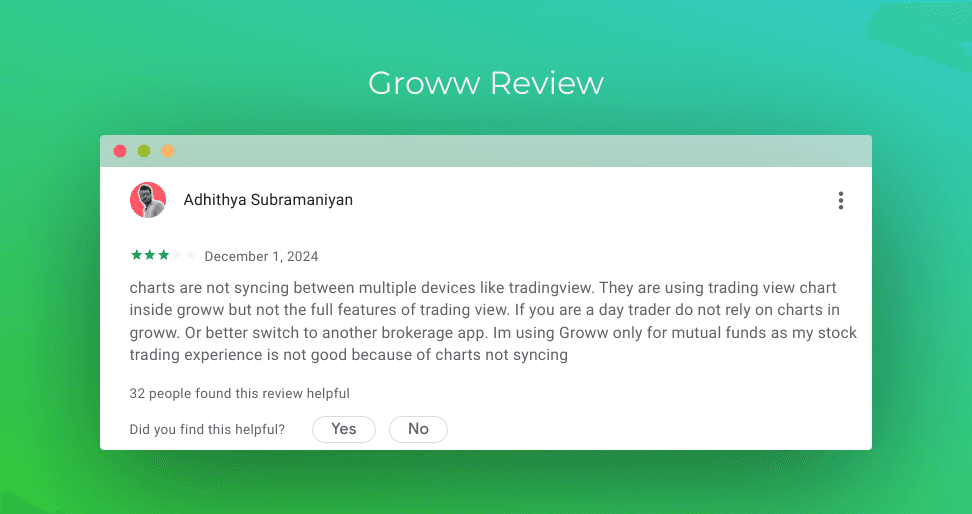

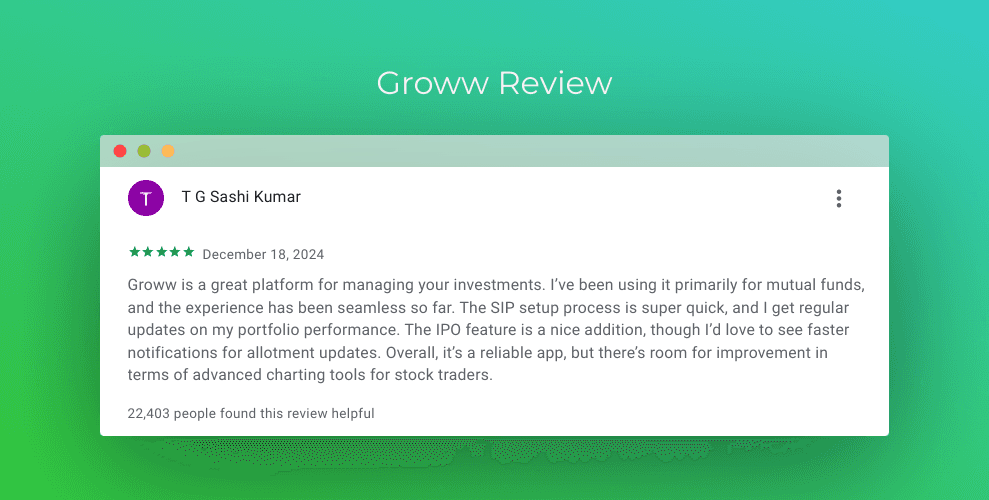

1 Star Review ⭐

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

Groww Key Features

- Extremely user-friendly and minimalistic design for hassle-free trading

- Quick, paperless account opening process

- Stock and mutual fund investments in one app

- Groww Pay for Bill Payments

Downside

- Lacks advanced technical analysis and customization features for experienced traders

- Occasional app bugs or minor glitches reported by some users

- Might feel too basic if you’re looking for in-depth research or advisory services

Trading Instruments

- Stocks and ETFs

- Futures & Options

- IPO

- Mutual Funds and NFO

- US Stocks and ETFs [PAUSED]

Fees

- Equity Delivery Fee - ₹20 or 0.1% per executed order, whichever is lower. A minimum charge of ₹2 will apply if the brokerage per trade is less than ₹2.

- Equity Intraday Fee - ₹20 or 0.1%/order (whichever is lower)

- FnO Fee - Flat ₹20

- Account Opening Fee - ₹0 (Free!)

- Demat AMC Fee - ₹0 (Free!)

Let’s see fees in a real scenario if you are buying for ₹100 and selling for ₹110, 1 Share.

For Equity

- Turnover: ₹210

- P&L: ₹10

- Charges: ₹4.74

- Groww Charges: ₹4

- Non-Groww Charges: ₹0.74

- NET P&L: ₹5.26

For Equity Intraday

- Turnover: ₹210

- P&L: ₹10

- Charges: ₹4.73

- Groww Charges: ₹4

- Non-Groww Charges: ₹0.74

- NET P&L: ₹5.27

For F&O

- Turnover: ₹210

- P&L: ₹10

- Charges: ₹47.28

- Groww Charges: ₹40

- Non-Groww Charges: ₹7.28

- NET P&L: -₹37.28

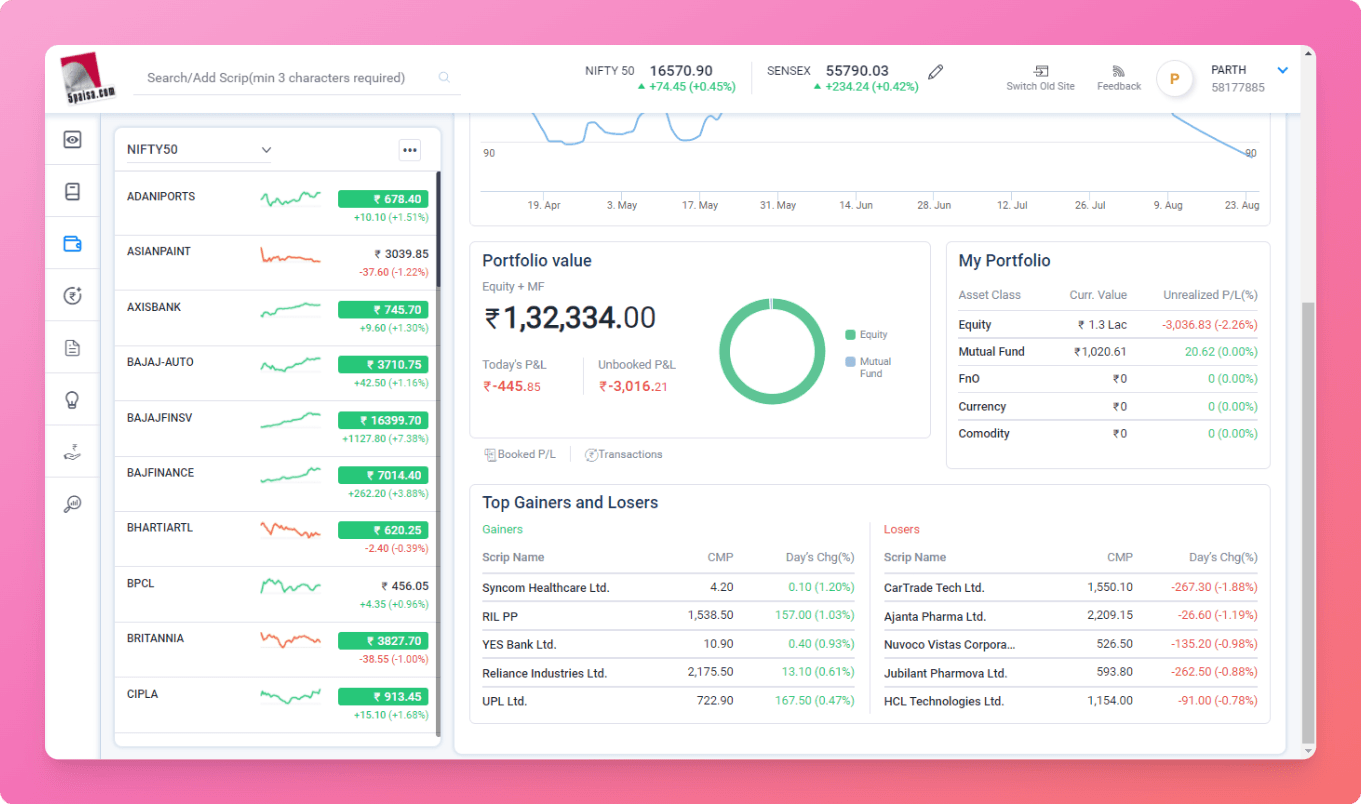

4. 5Paisa

If you’re the type who counts every rupee (no shame!), 5Paisa might feel like your frugal bestie.

Reddit users swear by its rock-bottom brokerage fees—perfect for traders placing lots of orders without burning cash. One reddit user joked, “It’s like a ‘budget meal’ for active traders!” The app packs in decent research tools, algo trading, and even mutual funds, making it a jack-of-all-trades.

But hey, some people say about the UI feeling a bit “2016 vibes” and slow customer support. As one Redditor put it, “You get what you pay for—cheap trades, but don’t expect a luxury spa experience.” Still, if cost-cutting is your thing, 5Paisa is worth trying.

Total Downloads - 10M+ Downloads

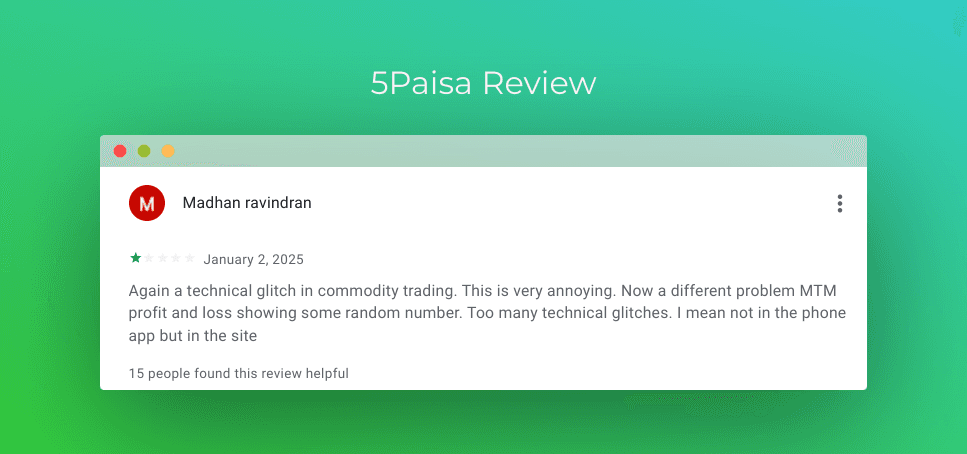

5Paisa Review(4.3/5)

1 Star Review ⭐

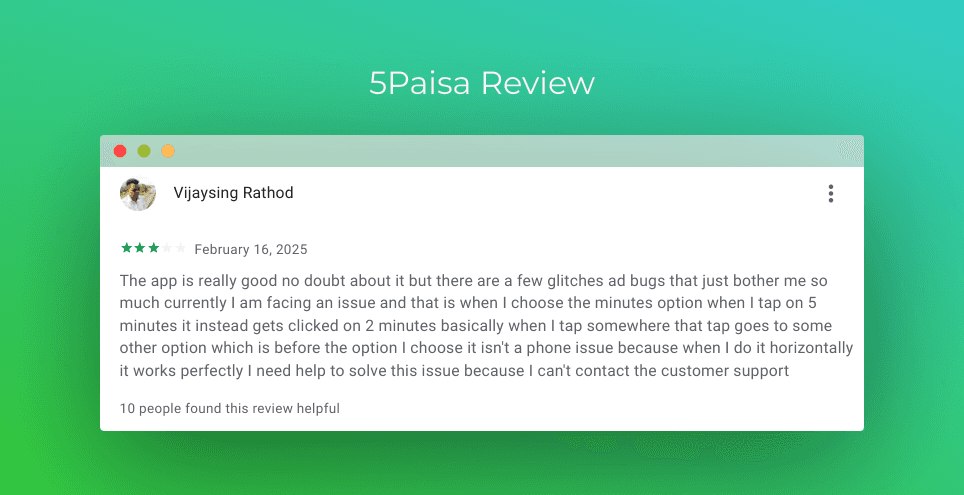

3 Star Review ⭐⭐⭐

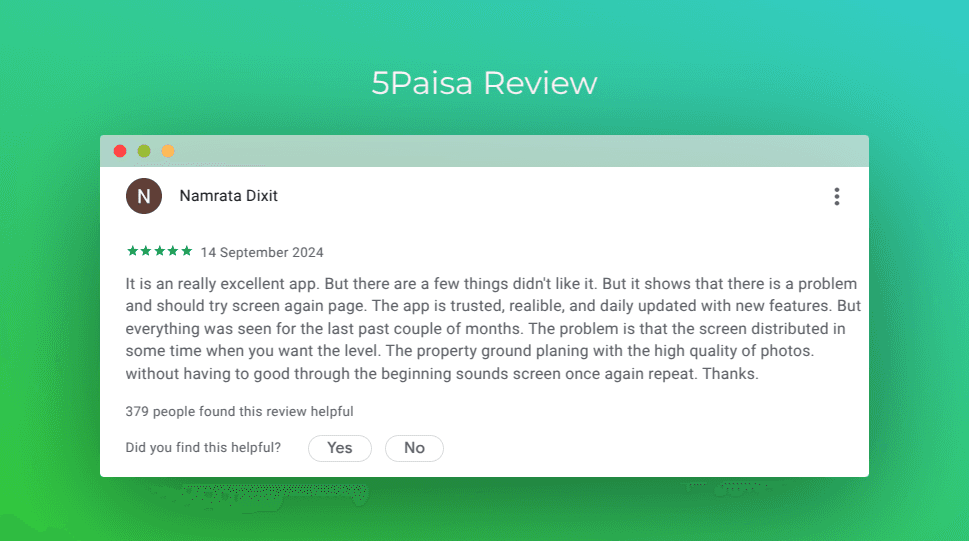

5 Star Review ⭐⭐⭐⭐⭐

5Paisa Key Features

- Consolidated dashboard for stocks, mutual funds, and SIPs

- Essential research reports and real-time market updates

- FnO360 Platform specifically for Derivatives trader

- Provides important market news, price alerts, and quick analytics so users can look at market sentiments and trade/invest accordingly

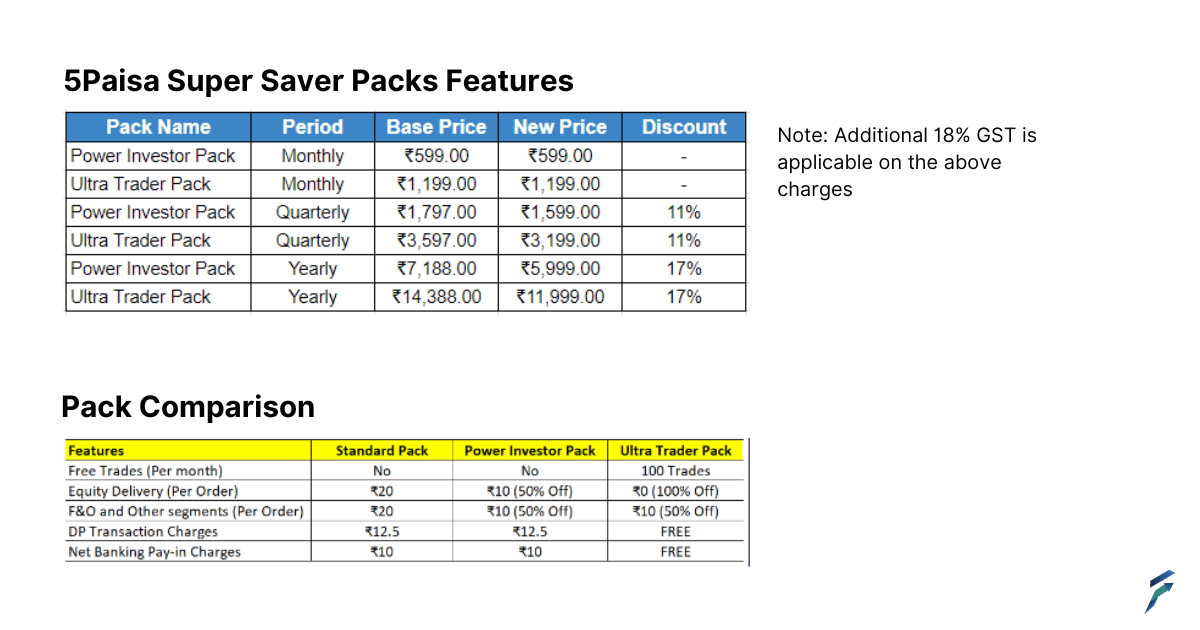

- Has fully focused plan for full-time traders (refer to the below image)

Downside

- Performance may slow during peak market hours

- Customer support can be a bit of a mixed bag (some users report long wait times)

- No demo account

- Platform can feel a bit cluttered at times

Trading Instruments

- Stocks and ETFs

- Mutual Funds & NFOs

- IPO

- US Stocks

- Derivatives

- Commodity

5Paisa Fees

- Equity Delivery Fee – Free

- Equity Intraday Fee – Flat ₹20 (or around 0.03% per order)

- FnO Fee – Flat ₹20 per order

- Account Opening Fee – Free

- Demat AMC Fee – ₹300 per year

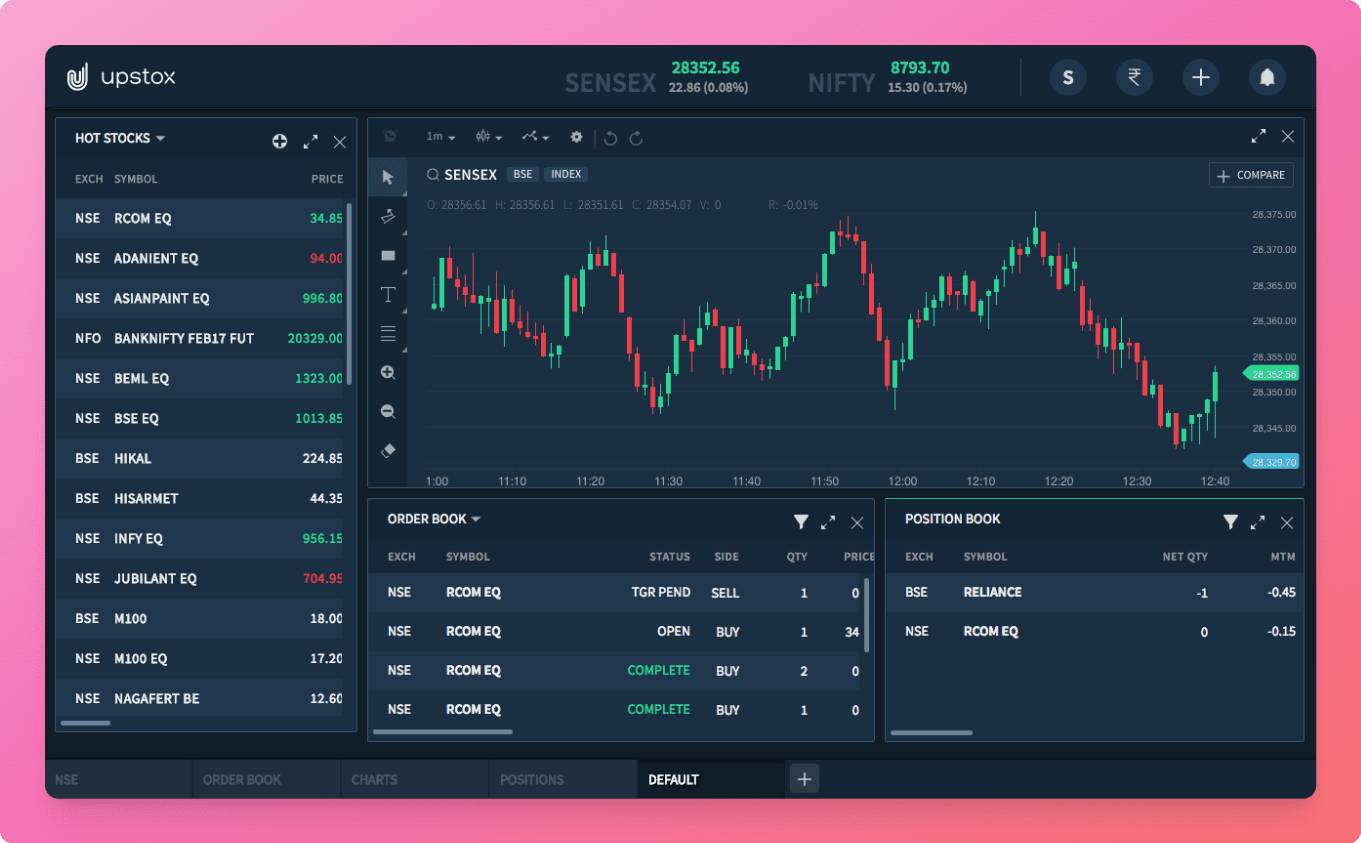

5. Upstox Pro

Upstox just works—no drama, no fancy tricks,” says a Reddit user who’s stuck with it for 6 years. The big win? Delivery trades cost ₹20 flat—no percentages, no surprises.

Perfect for folks buying stocks to hold long-term. Traders also dig features like free TradingView charts and algo trading APIs (code your own strategies, nerds!).

Upstox Pro is their advanced platform, offering more sophisticated charting tools and market analysis features. It’s got heatmaps, advanced screeners, and even a “TradingView” integration for chart addicts.

Total Downloads - 10M+ Downloads

Upstox Pro Review (4.5/5)

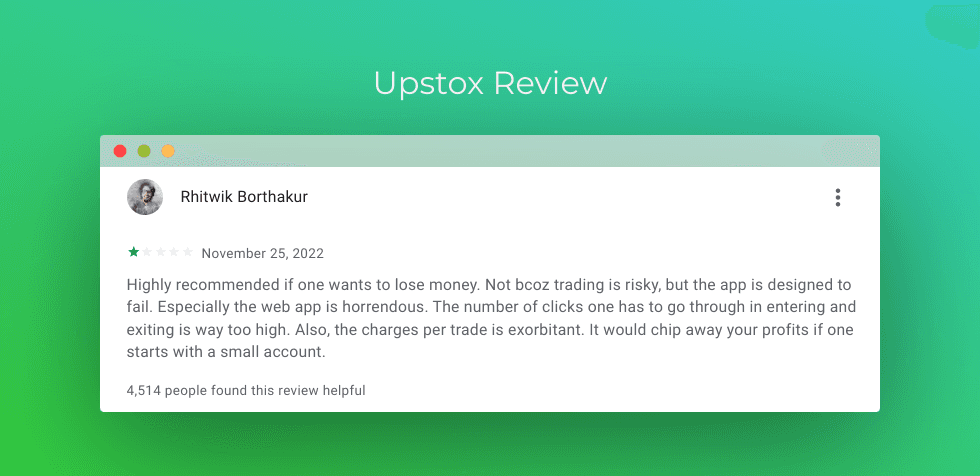

1 Star Review ⭐

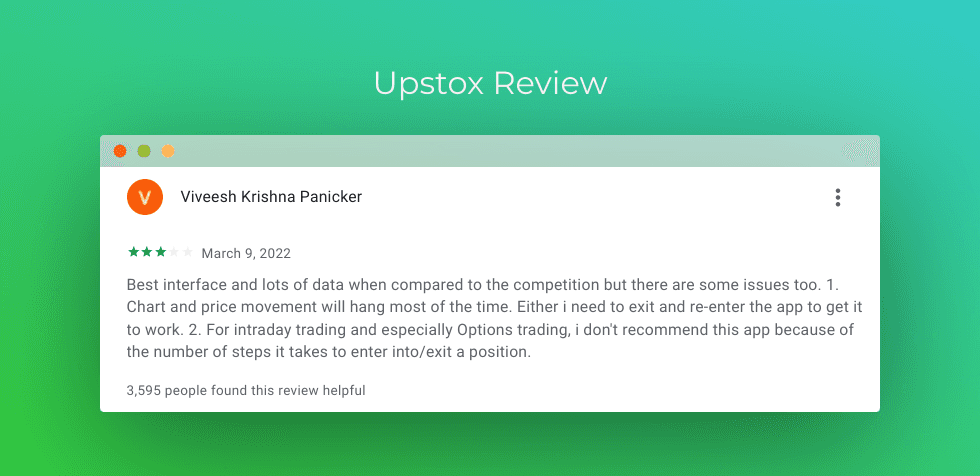

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

Upstox Key Features

- Two Modes: Upstox mode is for investors and Upstox pro mode is for professional traders.

- Advanced charting tools equipped with multiple technical indicators

- MTF Facility - Interest of ₹20/day for every ₹40,000 borrowed

- You can build your own app using the Upstox dev console.

- You can avail margins against shares

Downside

- The platform’s advanced features may be challenging for beginners

- Some features require extra clicks, potentially slowing down rapid tradesStock deliveries are paid. Other brokers give it for free

- No 24/7 Customer support

- Call and Trade Charges are ₹20/per order

- Limited educational resources compared to full-service platforms

Trading Instruments

- Stocks & ETFs

- Futures & Options

- IPO

- Currency derivatives

- Mutual Funds and NFO

- Commodities

- Govt securities

Upstox Fee

- Equity Delivery Fee – ₹20/per order

- Equity Intraday Fee – Flat ₹20 or about 0.01% per order

- FnO Fee – Flat ₹20 per order for futures and Flat ₹20/order for options.

- Account Opening Fee – Free

- Demat AMC Fee – First year free. ₹150+GST

Let’s see fees in a real scenario if you are buying for ₹100 and selling for ₹110, 1 share.

For Delivery

- Brokerage: ₹ 5.25

- Other Charges: ₹ 24.79

- Breakeven: ₹ 30.04

- Net PnL: ₹ -20.04

For Intraday

- Brokerage: ₹ 0.02

- Other Charges: ₹ 0.05

- Breakeven: ₹ 0.07

- Net PnL: ₹ 9.93

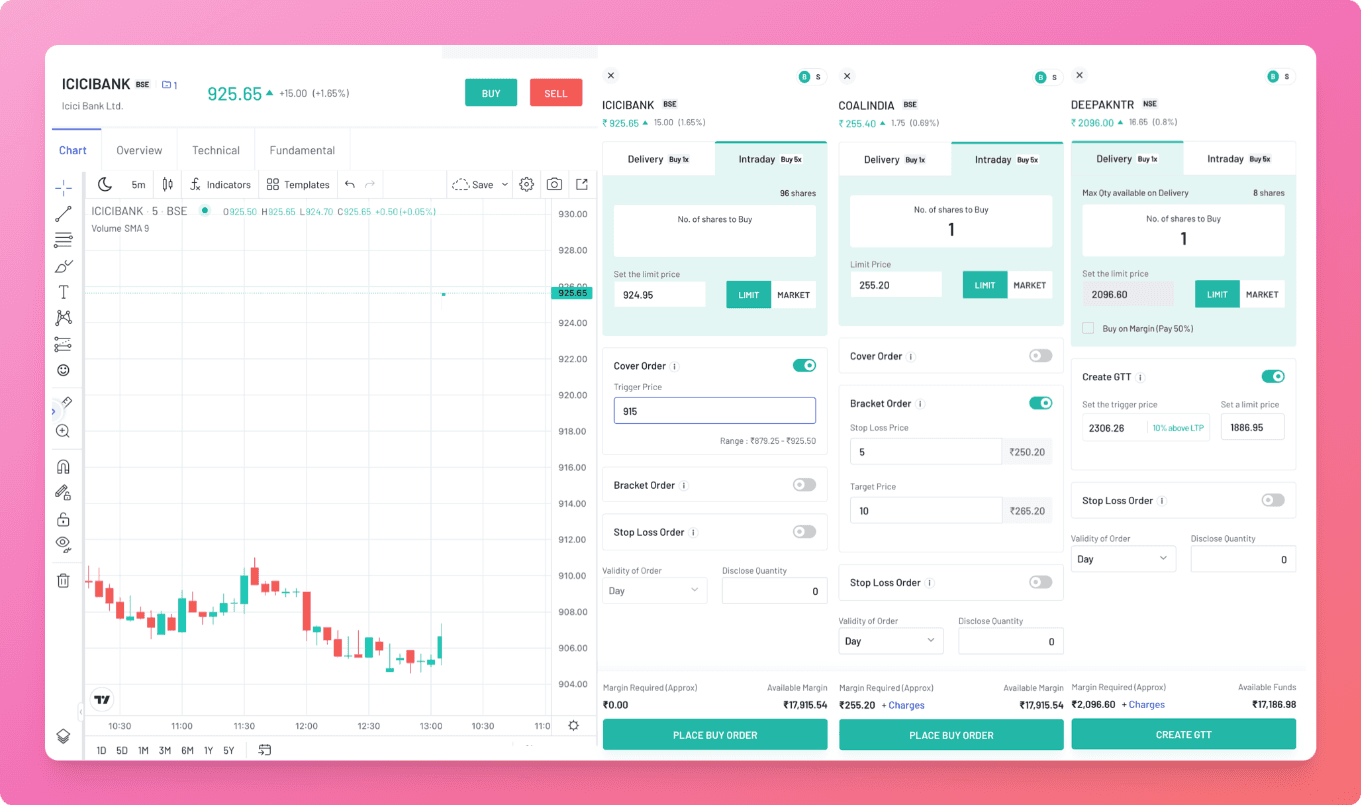

6. ICICI Direct

Think of ICICI Direct as that trusted app that has been around forever and knows his stuff. Reddit’s long-term investors love how it bundles everything—stocks, mutual funds, bonds—into one app. No more juggling accounts!

Plus, if you’re already an ICICI Bank customer, say goodbye to wallet top-ups—trades directly pull from your savings account.

The Prime Plan slashes brokerage to ₹9 per F&O lot—a steal for active traders. One user said, “It’s like getting VIP access without the yearly fees!” And for research? Their analyst reports are gold, especially for IPO insights.

Sure, the UI feels “classic” (read: not flashy), but people argue it’s built for speed.

Total Downloads - 5M+ Downloads

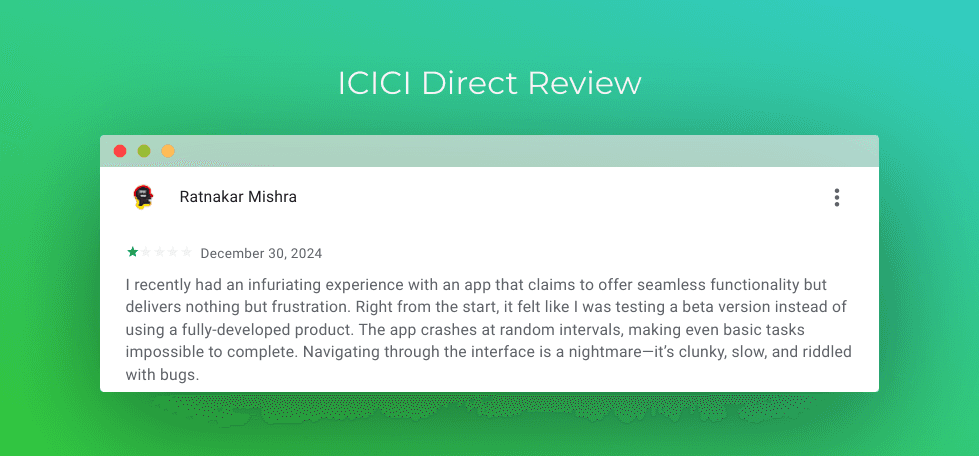

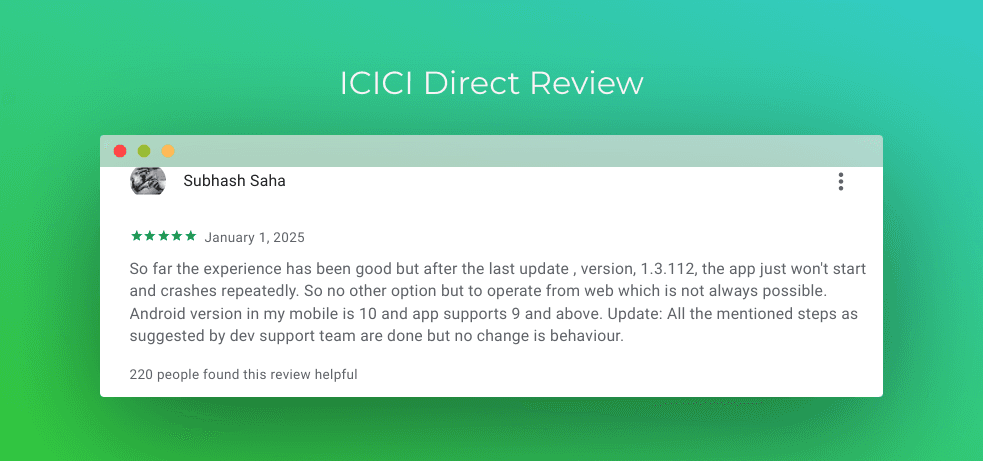

ICICI Direct Review(4.5/5)

1 Star Review ⭐

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

ICICIDirect Key Features

- Research powerhouse: Daily stock tips, sector reports, and webinars.

- Offline support: Walk into an ICICI branch if the app confuses you.

- NRI-friendly: Trade in INR from abroad (no forex headaches).

- 3 in 1 Account: Demat, Trading and Saving.

- Wealth basket: Pre-built portfolios for goals like retirement or travel.

Downside

- Higher brokerage fees and complex fee structures

- The interface can appear cluttered for new users

- Upsells insurance: Keeps nudging you to buy policies

Trading Instruments

- Stocks

- Bonds

- Commodities

- Derivatives

- IPOs

- Mutual Funds

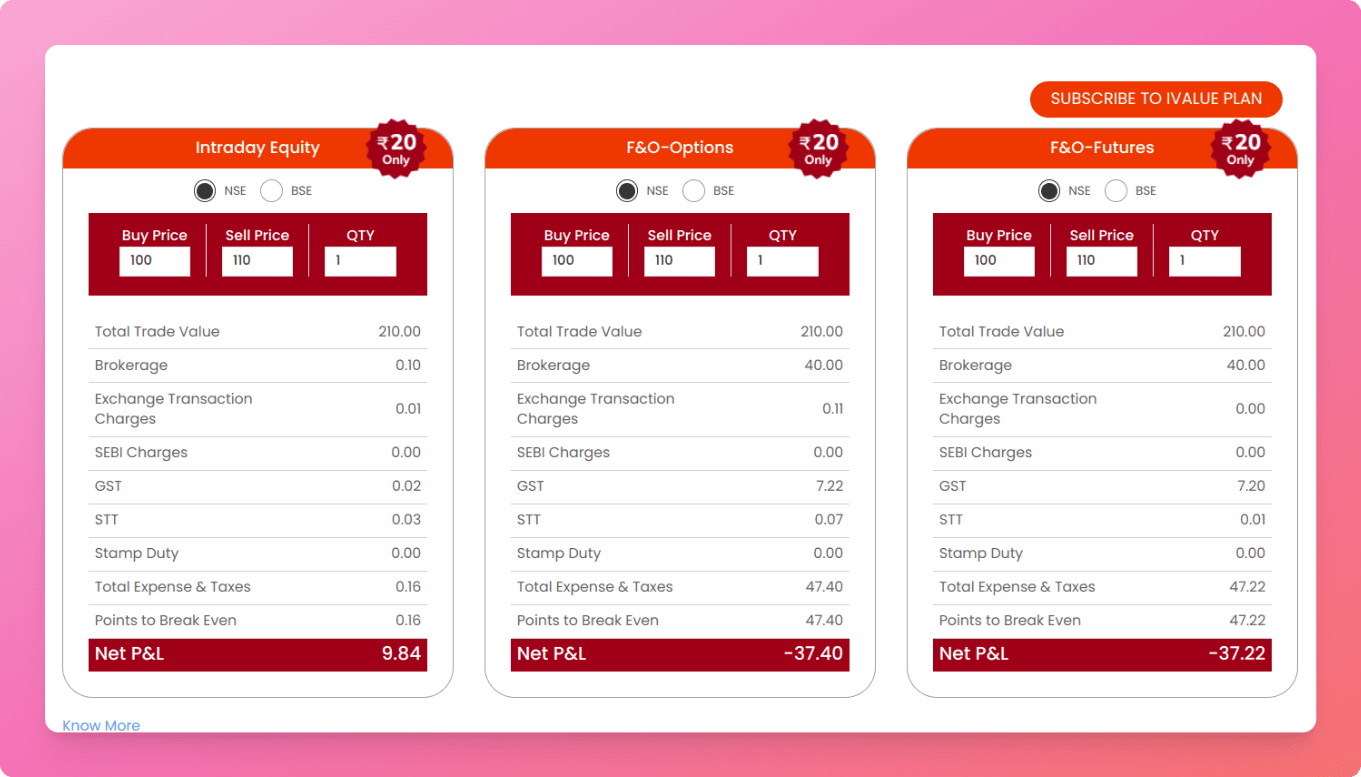

ICICIDirect Fees

Has 4 Plans for investors/traders the major ones are here:

- ICICIdirect Prime

- Currency F&O: ₹20/order

- Equity Futures: 0.026%

- Equity Options: ₹40/lot

- I - Secure Plan

- Currency F&O: ₹20/order

- Equity Futures: 0.050%

- Equity Options: ₹50

- Account Opening Fee – Free

- Demat AMC Fee – First year free. ₹700/year.

Let’s see fees in a real scenario if you are buying for ₹100 and selling for ₹110, 1 share.

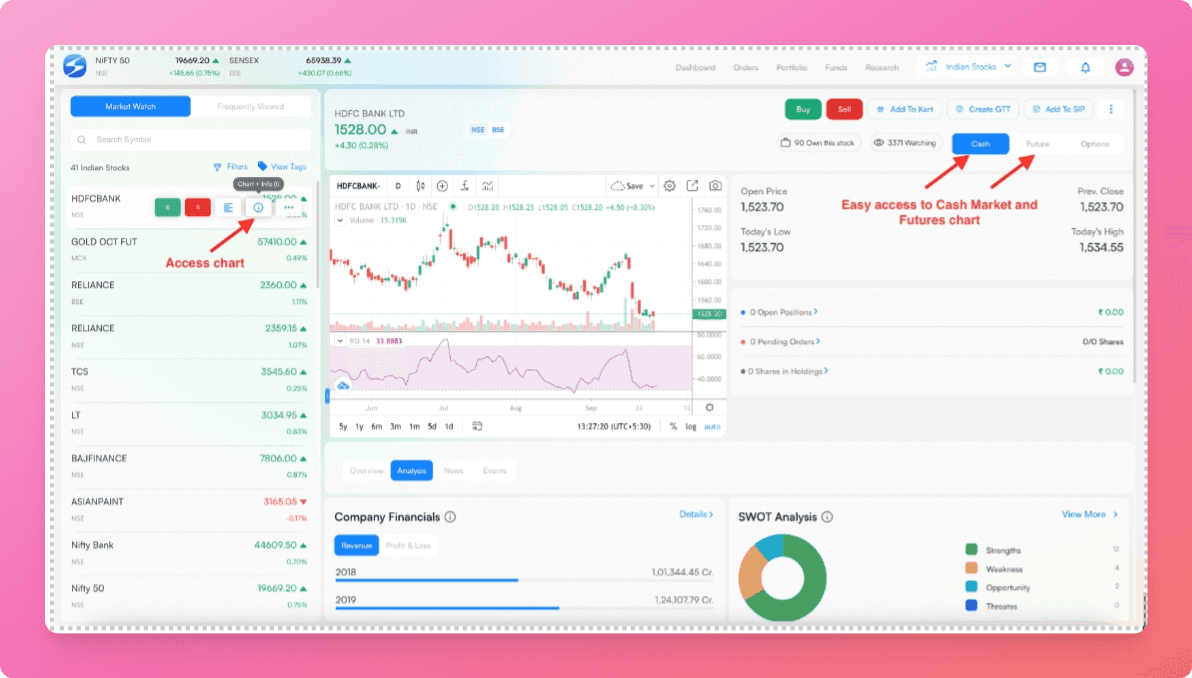

7. HDFC Sky

HDFC Sky stands out for its direct integration with HDFC Bank accounts, allowing instant fund transfers without manual top-ups—a feature praised by Reddit users for its convenience.

Investors also appreciate access to global markets, including U.S. stocks.

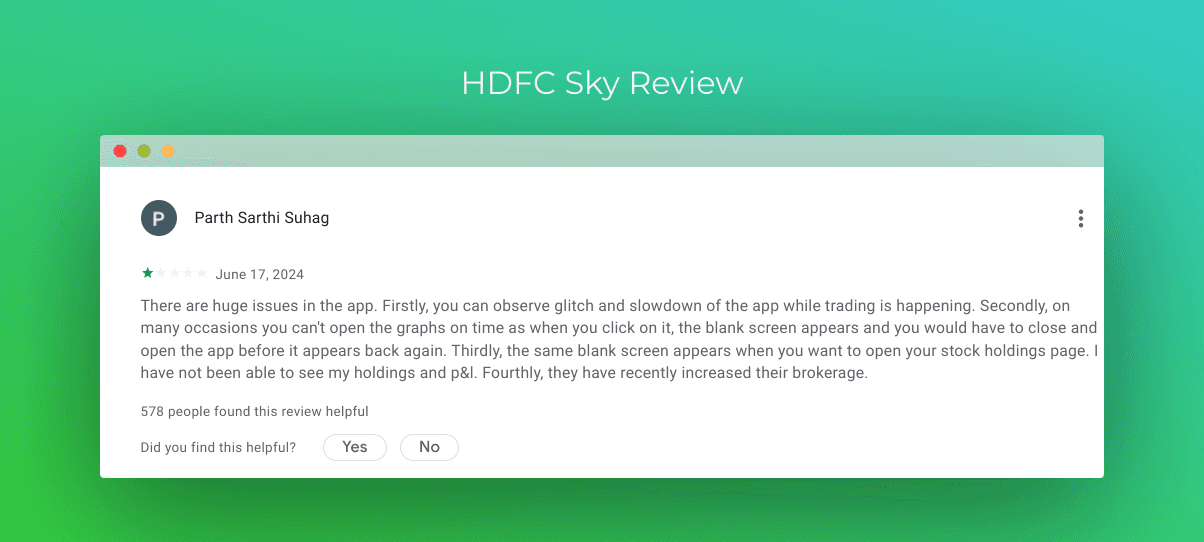

However, the app’s dated interface frustrates users. Customer support inconsistencies are another pain point, with reports of delayed resolutions for issues like missing funds.

Technical glitches during peak trading hours further dent its appeal for active traders.

Verdict: Ideal for HDFC loyalists and passive investors prioritizing bank integration and global exposure. For frequent traders, platforms like Zerodha offer smoother functionality.

Total Downloads - 5M+ Downloads

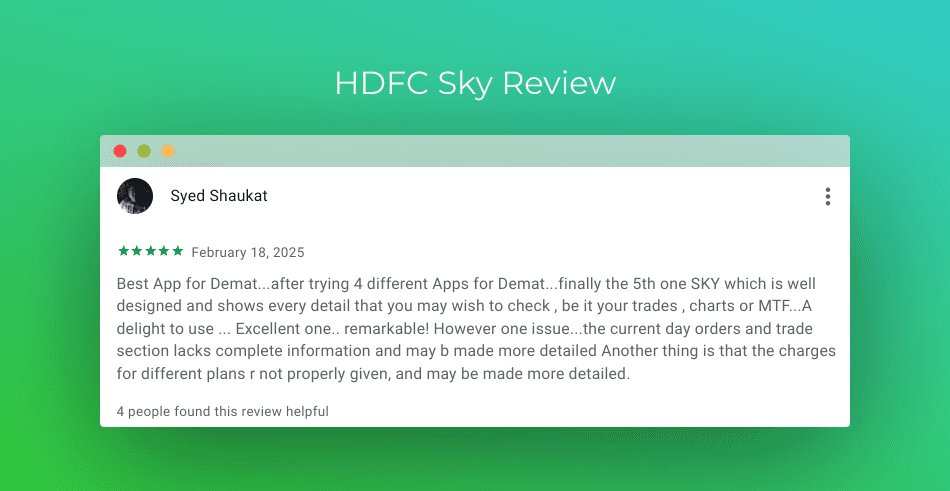

HDFC Sky Review (4.5/5)

1 Star Review ⭐

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

HDFC Sky Key Features

- Simple, no-nonsense interface that is easy to navigate

- Integration with HDFC’s banking services for smooth fund transfers

- Solid customer service and a wide support network

- Simple trading platform for beginners

Downside

- The design can seem dated compared to more modern platforms

- Advanced technical tools are limited for power traders

- High brokerage

- Slow updates: Charts lag during peak hours.

Trading Instruments

- Stocks and ETFs

- Futures & Options (F&O)

- Limited currency trading

- Derivatives

- IPO and SME IPOs

- Mutual Fund

HDFC Sky Fees

- Equity Delivery Fee – ₹20 per executed order or 2.5% of the order value, whichever is lower.

- Equity Intraday Fee – ₹20 per executed order or 2.5% of the order value, whichever is lower.

- FnO Fee – ₹20 per executed order or 2.5% of the order value, whichever is lower.

- Account Opening Fee – Free

- Demat AMC Fee – First year free. ₹240/year.

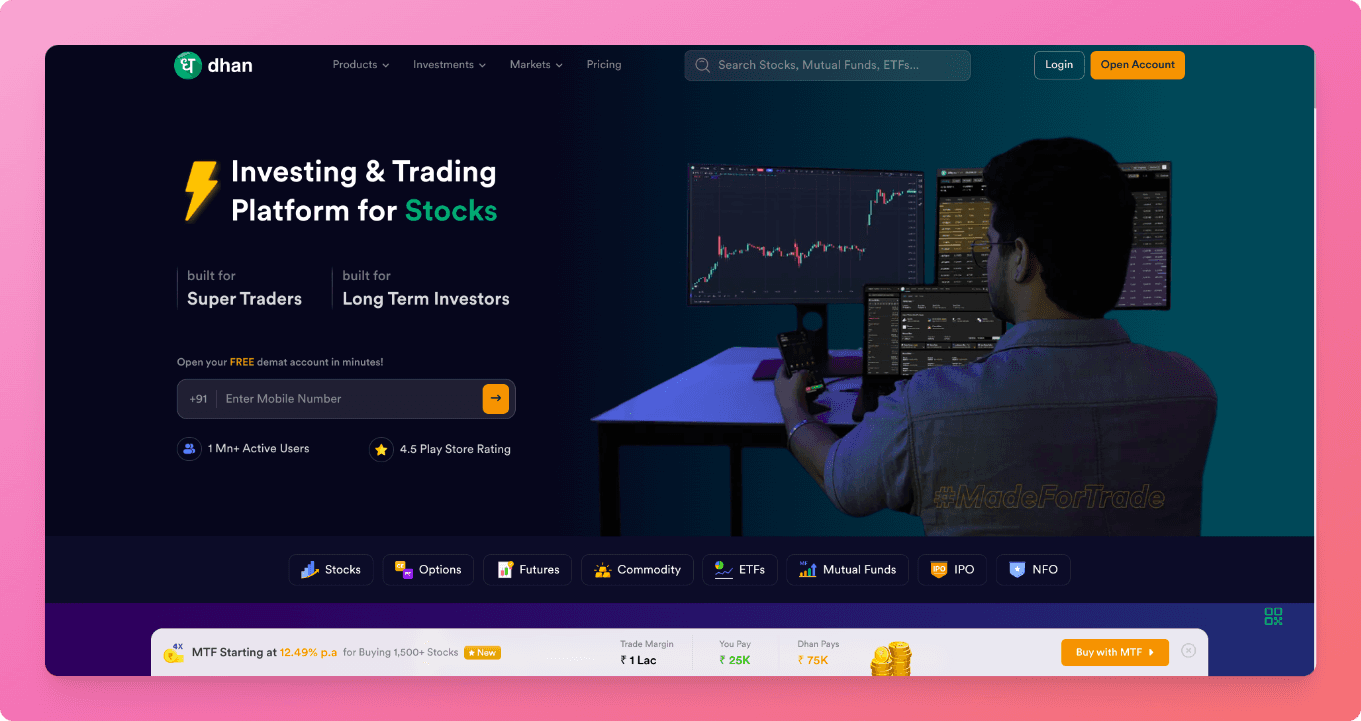

8. Dhan

Dhan is with zero brokerage on delivery trades and free TradingView integration, making it a hit for scalpers and F&O traders who crave chart-driven strategies.

Reddit users praise features like ScanX (a customizable stock screener) and options builders, calling it “budget-friendly for active trading.” However, the cluttered, slow interface—described as a “crowded bazaar”—frustrates beginners.

Technical snags like delayed P&L reports and unreliable customer support add some time to your life. While traders tolerate its quirks for cost savings and advanced tools, newbies might find it overwhelming.

Verdict: A solid backup for tech-savvy traders; stick to Zerodha/Groww for simplicity.

Total Downloads - 5M+ Downloads

Dhan Review (4.5/5)

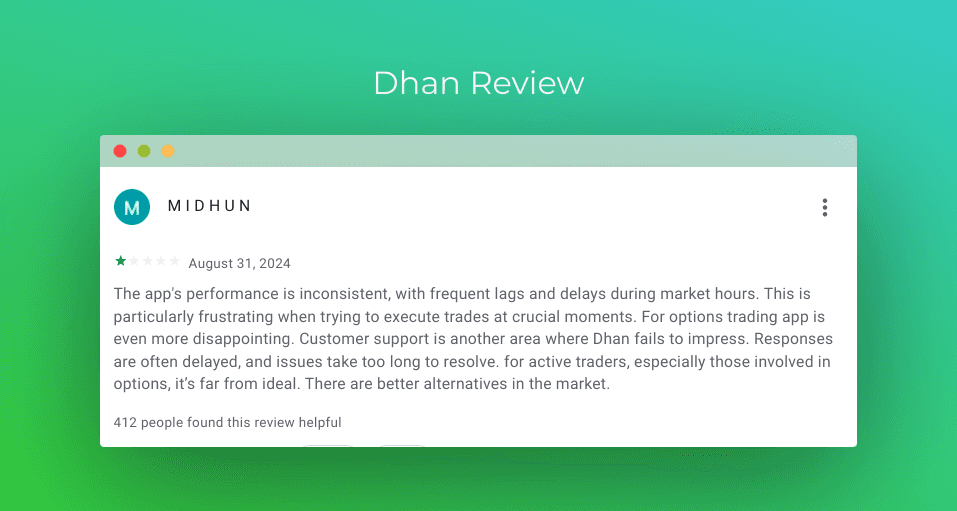

1 Star Review ⭐

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

Dhan Key Features

- Turbo orders and for traders: lightning-fast execution.

- Customizable Alerts: Advanced notification settings to set alerts on price levels, volume spikes, or technical thresholds.

- Regular updates and new features

- Heavy tech-packed platform

- Simple trading process and user friendly

Downside

- Occasionally, during high traffic periods, the interface may experience minor lags.

- Advanced chart customization options could be further enhanced to compete with top-tier platforms.

- Customer support needs more work.

Trading Instruments

- Stocks

- Futures & Options

- Commodity

- ETFs

- Mutual Funds

- IPO

- NFO

Dhan Fees

- Equity Delivery Fee – Free

- Equity Intraday Fee – Flat ₹20 (or approximately 0.03% per trade)

- FnO Fee – Flat ₹20 per order

- Account Opening Fee – Free

- Demat AMC Fee – Zero

Let’s see fees in a real scenario if you are buying for ₹100 and selling for ₹110, 1 share.

For Intraday

- Trade Value: ₹ 210.00

- Brokerage: ₹ 0.06

- Other Charges: ₹ 0.05

- Gross P&L: ₹ 10.00

- Net P&L: ₹ 9.89

For Delivery

- Trade Value: ₹ 210.00

- Brokerage: ₹ 0.00

- Other Charges: ₹ 14.98

- Gross P&L: ₹ 10.00

- Net P&L: ₹ -4.98

9. Motilal Oswal

Motilal Oswal might seem like a trusted name, but Reddit says a different story. New investors often face relentless calls from advisors pushing risky F&O trades or "hot stock picks" that rarely pan out. One user lost ₹6,500 in two weeks after blindly following bearish recommendations, only to realize hidden brokerage fees ate into their capital.

The app itself feels clunky, with slow updates and no seamless tax-reporting tools, making portfolio tracking a headache.

For beginners? Steer clear. Platforms like Zerodha or Groww offer simpler interfaces, zero spam, and fewer fees.

Total Downloads - 10M+ Downloads

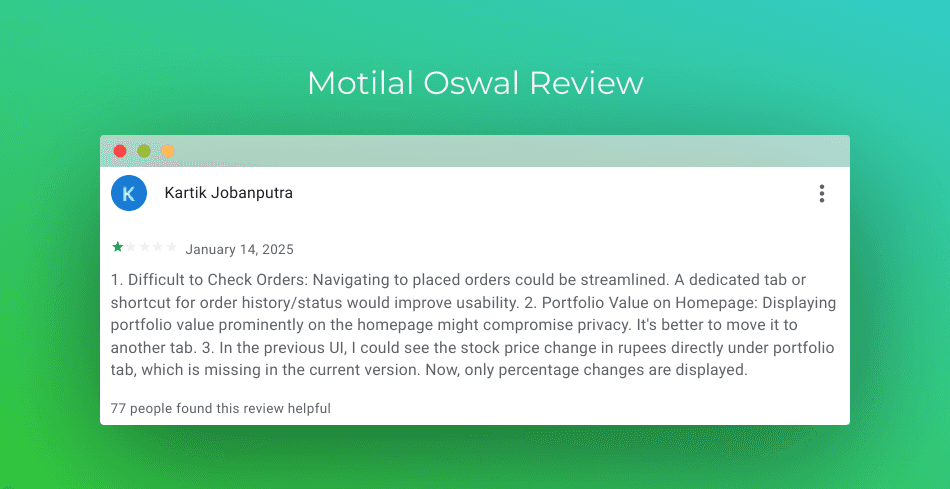

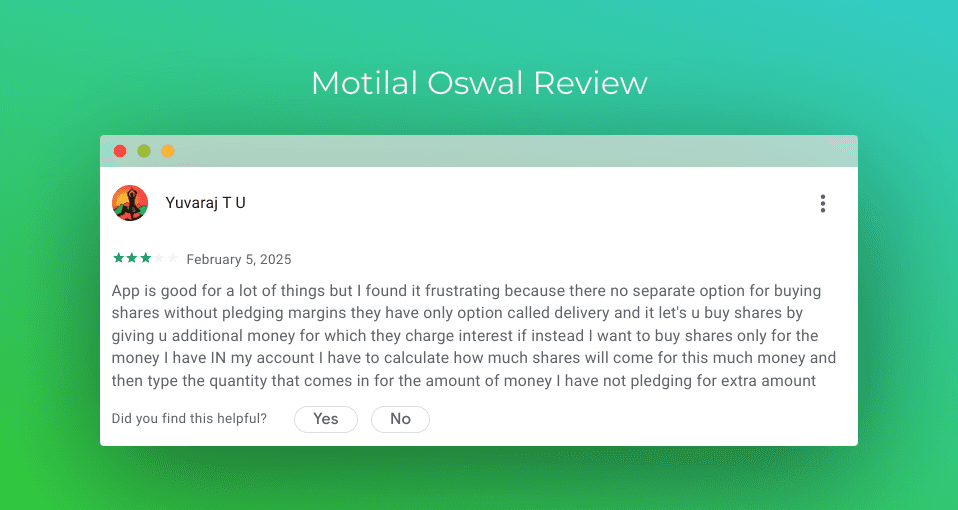

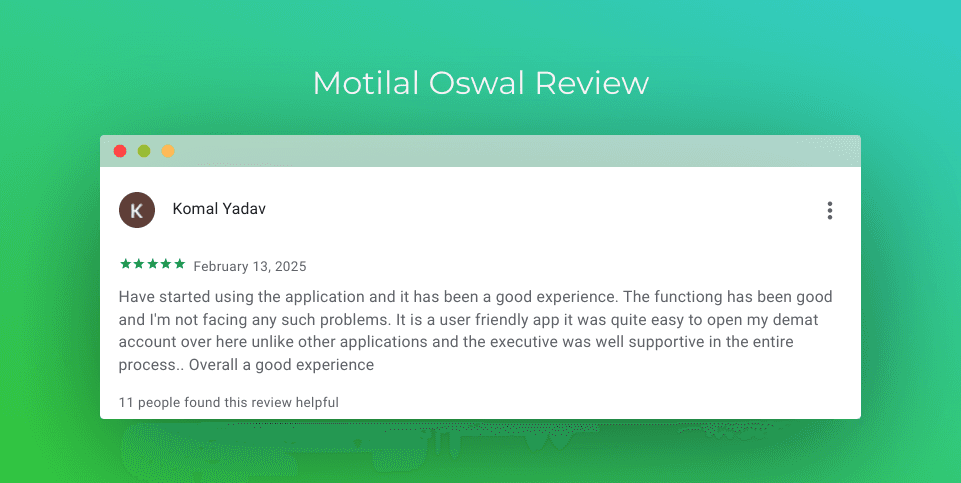

Motilal Oswal Review (4.4/5)

1 Star Review ⭐

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

Motilal Oswal Key Features

- Multi-Channel Trading: Provides a seamless experience across web, mobile, and branch channels.

- Options store for different strategies powered by experts and algorithms.

- Supports all type of investment options.

- Portfolio Management Services for Elite Investors

Downside

- Brokerage fees can be higher compared to others in the list.

- Mobile and Web apps may not be that advanced than the apps in the list.

Trading Instruments

- Equity (Stocks)

- Futures & Options (F&O)

- Currency Derivatives

- Mutual Funds

- Commodities

- FD

- Intelligent Advisory Portfolios (IAP)

- Alternative Investment Funds (AIF)

- US Stocks

Motilal Oswal Fees

- Equity Delivery Fee – 0.20%

- Equity Intraday Fee – Free.

- FnO Fee

- Equity Futures: 0.02%

- Equity Options: ₹20 per lot

- Currency Futures: ₹20 per lot

- Currency Options: ₹20 per lot

- Commodity Futures: 0.02%

- Commodity Options: ₹200 per lot

- Account Opening Fee – Free

- Demat AMC Fee – First year free. ₹199/year.

10. mStock by Mirae Asset

mStock is the trading platform from Mirae Asset, a global financial services company. They've positioned themselves as a discount broker offering a wide range of investment options.

It’s a platform designed for both active traders and long-term investors through an array of innovative features—ranging from zero brokerage on equity delivery to an advanced Pay Later (MTF) facility with rates as low as 6.99% p.a.

It is has a compelling all-in-one solution for those who want to trade smarter, faster, and more cost-effectively.

Total Downloads - 10M+ Downloads

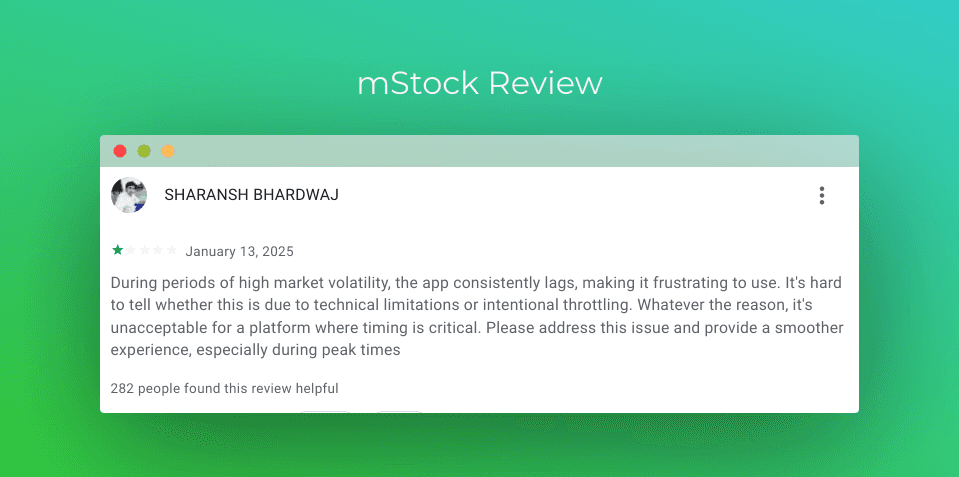

mStock Review (4/5)

1 Star Review ⭐

3 Star Review ⭐⭐⭐

5 Star Review ⭐⭐⭐⭐⭐

mStock Key Features

- Provides up to 80% funding at interest rates starting as low as 6.99% p.a

- mStock’s design is both powerful and adaptable. With support for multiple watchlists, one-click order placements, and even voice search

- Equipped with TradingView chart integration and an in-depth option chain

- Backed by Mirae Asset Capital Markets, mStock is built on a stable, secure infrastructure designed to handle high trade volumes

- ₹0 Charges on call & trade service

Downside

- Occasional interface glitches and slower refresh rates during peak trading hours

- The platform’s advanced customization options aren’t yet as extensive

Trading Instruments

- Stocks and Equities

- Futures & Options (F&O)

- Mutual Funds

- ETFs

- Currency Derivatives

- IPOs

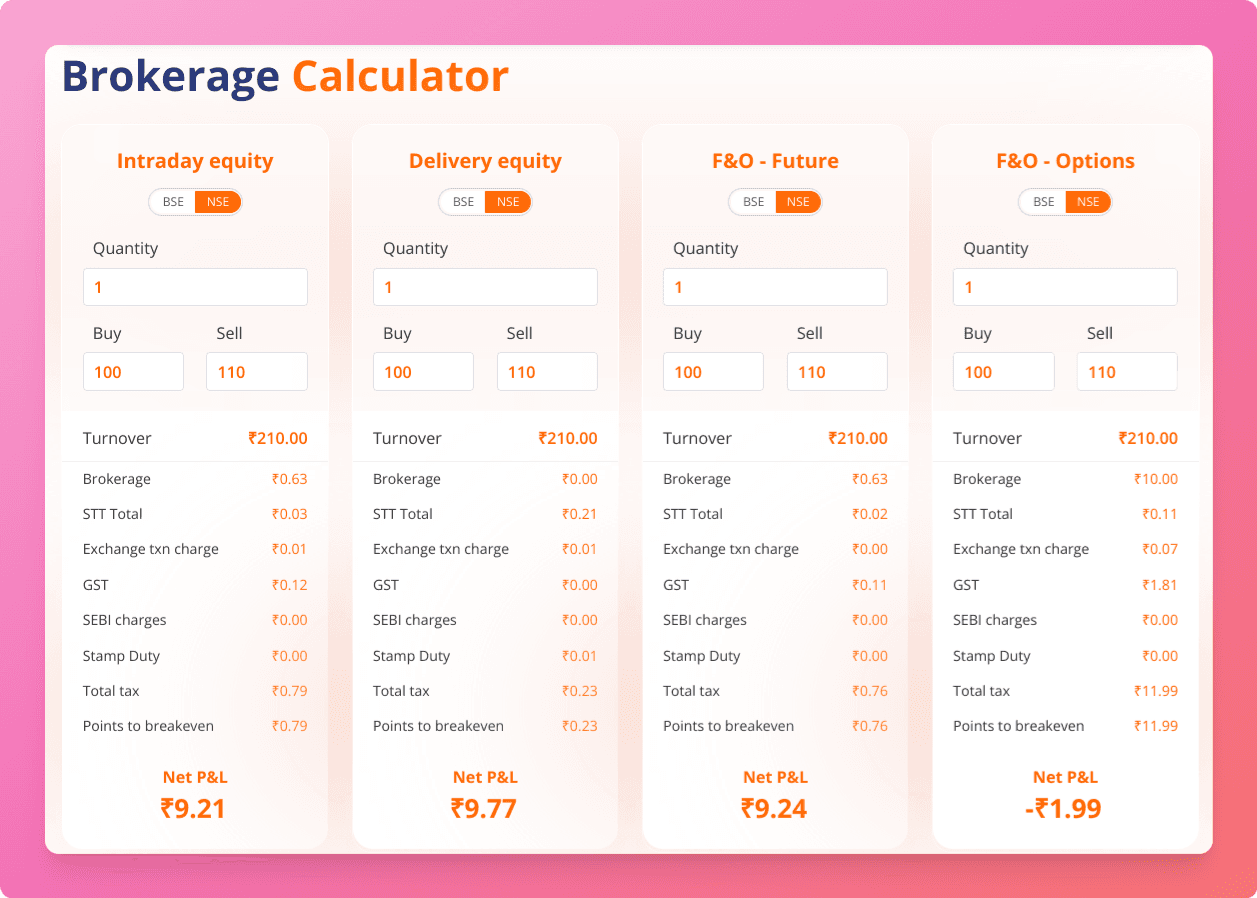

mStock Fees

- Equity Delivery Fee – ₹0

- Equity Intraday Fee – ₹5/order

- FnO Fee – ₹5/order

- Account Opening Fee – Free

- Demat AMC Fee – ₹0

Let’s see fees in a real scenario if you are buying for ₹100 and selling for ₹110, 1 share.

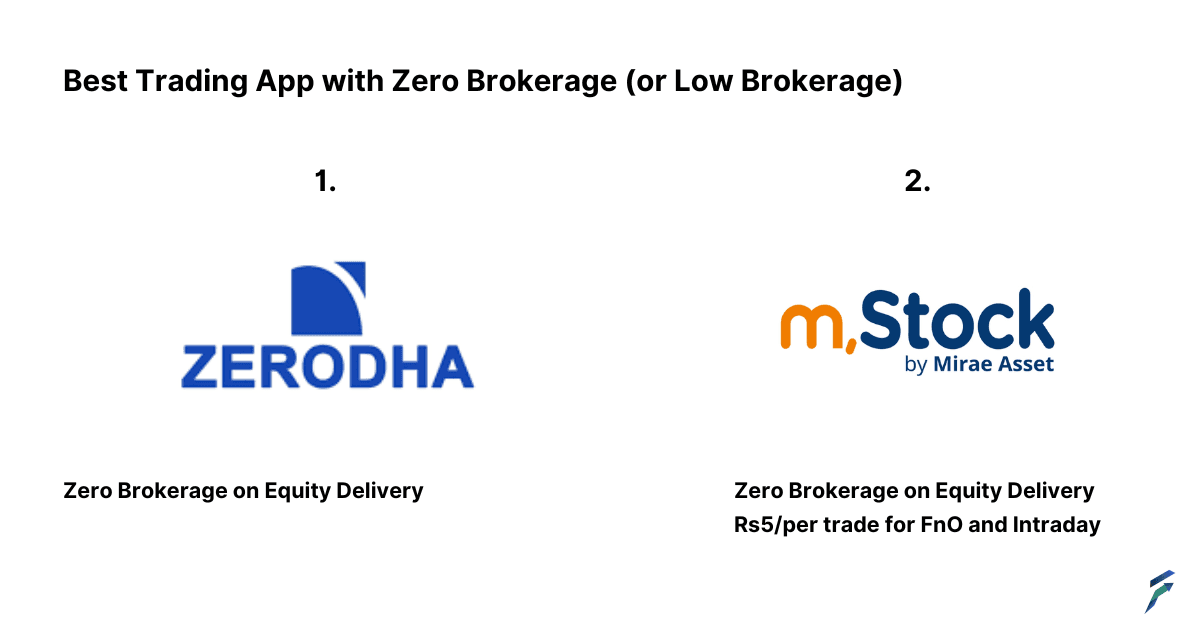

Best Trading App with Zero Brokerage (or Low Brokerage)

Brokerage fees are the charges most trading platforms impose for executing your trades, which can add up over time and cut into your profits.

Fortunately, some platforms stand out by offering zero brokerage fees or extremely low fees. Let’s see two best options.

1. Zerodha Kite Zerodha is renowned for charging zero brokerage on equity delivery trades, making it ideal for long-term investors. This means you can buy and hold stocks without worrying about brokerage fees.

2. mStock by Mirae Asset

mStock takes cost-effectiveness a step further by offering one of the lowest fee structures in the industry for active Future & Options trading, which is just ₹5/per trade.

Takeaway

So, we've explored a bunch of trading apps, each with its own strengths and weaknesses. Choosing the "best" one really depends on you – your trading style, your budget, and what you're looking for in a platform. There's no one-size-fits-all answer.

Quick Checklist to Help You Decide:

- What kind of trader are you? Long-term investor or active trader?

- What instruments do you trade? Stocks, F&O, commodities?

- What's your budget? Consider brokerage fees, account opening fees, and other charges.

- What features are important to you? Advanced charting, research tools, user-friendly interface?

- Do you need integration with your bank account?

- What about customer support? Is it readily available and helpful?

In a Nutshell:

- Zero brokerage on delivery? Zerodha is a great option.

- Lowest brokerage overall? mStock is hard to beat.

- Simple and beginner-friendly? Groww and Paytm Money are good starting points.

- Advanced features and tools? Upstox Pro and Dhan are worth exploring.

- Full-service brokerage with research? ICICI Direct, HDFC Sky, and Motilal Oswal are established players.

- Wide range of products? 5Paisa and Angel One offer diversified options.

This was it. Happy trading. Don't forget to check out the calendar for NSE market holidays.

Maximize your trading potential with Finosauras. We collect trading recommendations from Youtube, X, Reddit, Telegram, etc., so you don't have to. Download Finosauras and discover new opportunities today!